NITROGEN METHODOLOGY

Risk Done Right

Why do wealth management firms choose Nitrogen to do their due diligence?

Find out below.

We built Nitrogen from the security level up.

We reject the lazy status quo, which is to map every security to an asset allocation and assume those securities will march in lock-step together.

We built Nitrogen the hard way—the right way—by using security-level risk assessment as the building blocks for analysis.

We believe data selection is critical.

We cover over 900,000 securities (stocks, bonds, ETFs, mutual funds, SMAs, REITs, annuities, and non-traded alternatives).

While everyone else might analyze them with an arbitrary 1, 3, 5, or 10-year look-back period, we use a data set that doesn’t “conveniently” leave out 2008.

We believe price is truth.

We don’t try to replace what the markets actually did with subjective assumptions and guesswork.

Nitrogen recalculates all analytics at the security level every single night.

No liquid market price? See what goes into calculating something like a non-traded REIT.

It all starts with the Risk Number®

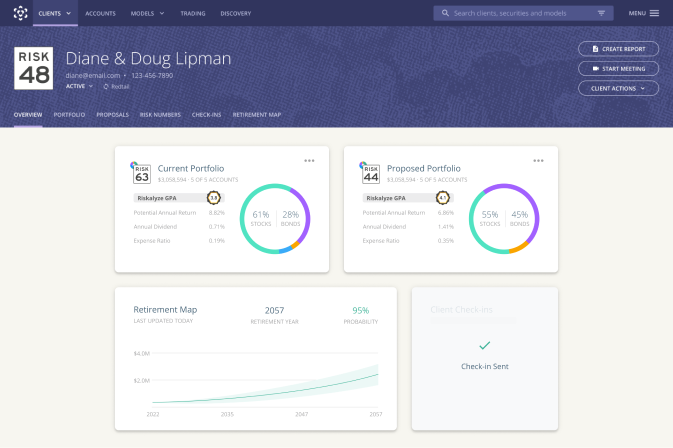

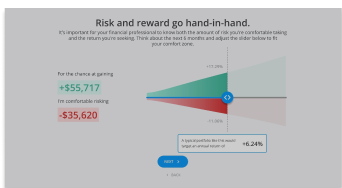

Built on a Nobel Prize-winning framework, the Risk Number is a proprietary scaled index developed by Nitrogen to reflect risk for both advisors and their clients. It sits at the heart of a sophisticated set of tools to precisely measure an investor’s appetite and capacity for risk, as well as the risk of a security, model, account, or portfolio.

How is it Calculated?Meet the 95% Historical Range™

While there’s 5% of the risk nobody can quantify, the 95% Historical Range helps set expectations for investors in six month intervals based on a historical calculation using a variety of statistical inputs based on the price history (expense ratios, dividends, etc.) at the holding level.

Introducing GPA®

GPA is a quantitative expression of the efficiency of an investment, strategy, or portfolio with respect to how much return is realized or expected per unit of risk. It’s a proprietary calculation made up of industry-standard measurements of risk-adjusted returns. Other risk-adjusted return metrics (like the Sharpe Ratio) make assumptions that hinder their stability and scalability, but GPA offers financial professionals and their clients a robust solution across sectors.

We Strive to Set Ourselves Apart From…

Those who assume that an investment will behave like its asset class suggests it should.

Those who use subjective extrapolation to make assumptions about young securities.

Those who stereotype risk tolerance based on age, time horizon, or market sentiment.

Those who try and assess risk tolerance without incorporating dollar amounts meaningful to each investor.

Those who recklessly present visuals as truth despite the analysis being fraught with assumptions.

Those who don’t believe risk is quantifiable, and instead opt for guesswork.

Built with Integrity

We answer questions objectively and mathematically with data whenever we can, and err on the side of safety when we can’t.

We won’t take money from a prospective customer to make their investment strategies appear in an untruthful or inaccurate light.

We care deeply about our core values that drive our decision-making and fuel our mission of empowering the world to invest fearlessly.

Trust Our Dedicated Risk and Methodology Team

The industry’s best analysts are always working to ensure that our data coverage is both expansive and objectively accurate.