Google, Yahoo, and the Future of Security Screening

Technology is a game of constant disruption, and nobody knows it better than the search engines that emerged at the turn of the century.

Remember the great search engine battle between Google and Yahoo? While it may not seem immediately apparent, in a number of ways, fund discovery for RIAs mimics that contest.

Obviously, Google emerged the winner. To understand why and see how new technology is set to similarly usurp traditional fund screening and discovery methods, let’s travel back to 1994, when the top song on the radio was “The Sign” by Ace of Base, and Yahoo was first introduced.

Yet Another Hierarchical Officious Oracle

Founded by Jerry Yang and David Filo, the search engine eventually known as Yahoo was actually first called Jerry and David’s Guide to the World Wide Web. Its official name, Yahoo, stands for Yet Another Hierarchical Officious Oracle. Jerry and David didn’t know it, but they built its demise right into the name itself.

Yahoo was built on a hierarchical structure, which means that it acted as a screener for websites. To get to what you wanted, you’d begin by selecting business and economy, then economic indicators, then Bureau of Economic Analysis — and so forth, drilling deeper and deeper until you finally found what you were looking for.

If you never had to use Yahoo for search, and that process sounds tedious and slow—that’s because it was. Think of it like this, as described by Danny Sullivan, contributing Search Engine Land author:

“With Yahoo, it was as if you were searching for books in a library using an old-fashioned card catalog system, where all you knew about a book was 25 words or so describing it.”

(If you never had to use an old-fashioned card catalog system, consider yourself lucky.)

Now, contrast that with Sullivan’s description of Google:

“With Google, it was as if you could search through every page of every book in the library. You didn’t miss that needle in a haystack. And importantly, unlike previous search engines that used automation, you didn’t find that the “noise” of looking through all those pages drowned out the important relevancy “signal.” Google’s search algorithm was better than others.”

When Google arrived on the search engine scene in 1998, it did something very different. Instead of trying to organize the information available on the web like Yahoo did, Google built its information retrieval system by closely tracking cross-references, or links between pages, in real time and correlating their relevance with their quantity.

Using Google, you can simply search for the words related to what you want to find. Its algorithm categorizes results by importance and relevance using backlink popularity as a guide.

The Old Way to Discover Funds

Much like Yahoo, a number of advisor technology products emerged in the 90s:

- Investment research designed to help you search for and discover new funds

- Portfolio analytics to measure the way portfolios stood up over time

- Client engagement tools to help investors understand the solutions you proposed

The problem isn’t those tools themselves. When they emerged, they were revolutionary.

The problem is that it’s 2022, and we’re still using them much in the same way — especially when it comes to discovering new funds.

For advisors, the legacy way of discovering funds is a lot like trying to find information on old-school Yahoo: cumbersome drop down lists and filters make it nearly impossible to locate what you want quickly and efficiently.

Typically, when you build a portfolio, you reach for a familiar set of tools — the reliable funds you’ve always used to build portfolios.

But in a few circumstances, you might need to enhance that toolbox:

- If there’s an opportunity to upgrade a core fund choice

- If you need something special to solve a client’s particular need or desire

Unfortunately, because of the way investment research works today, doing so mirrors the old Yahoo experience:

First, you select which fund type you’re looking for and generate approximately 13,547 options.

Then, you scroll through a nearly infinite list of possible filters. Once you pick one, congratulations! Your list has been narrowed down to 9,289 options.

Then you filter again. And again. You may have to fill out a text box asking for something that’s not entirely clear. 2,362 options. Filter again. And again.

Five minutes and 45 clicks later, you might be looking at a manageable list of funds.

The problem, besides wasted time and energy?

You don’t actually need such dense filtering criteria to find the right fund. In fact, we’ve found that most advisors really only use about 13 criteria.

How Nitrogen Fund Discovery is Changing the Game

At Nitrogen, we knew the legacy fund discovery process needed an overhaul. There had to be an easier, more intuitive way for advisors to search the universe of securities to discover fund upgrades or solve specific problems for their clients.

So we reimagined the entire process to develop Nitrogen Fund Discovery—or, more simply, Discovery.

Here’s how it works.

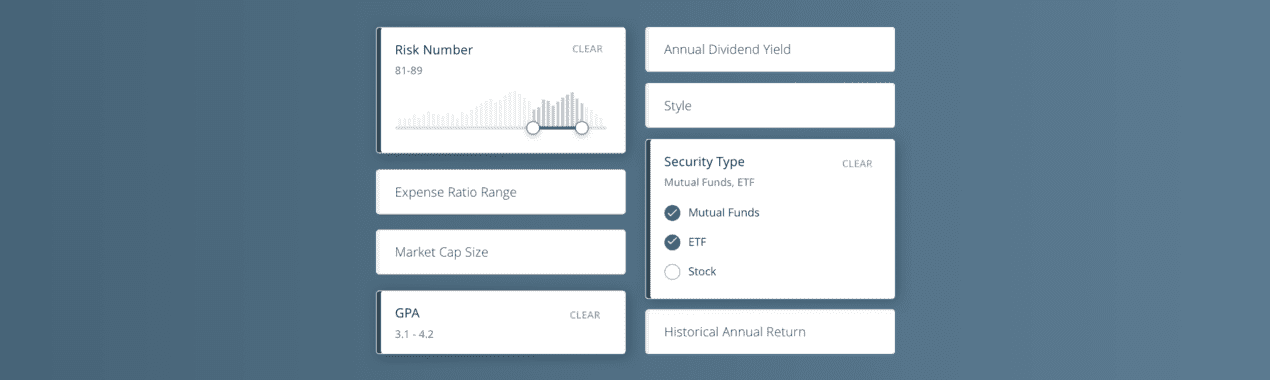

When you search for funds in Discovery, you’ll narrow your list with the 13 most commonly used criteria we mentioned above, including:

1. Risk Number®: An objective, quantitative measurement of an investor’s true risk tolerance and the risk in a portfolio on a scale from 1-99, utilizing a scientific framework that won the Nobel Prize for Economics

2. GPA®: A quantitative expression of the efficiency of an investment, strategy or portfolio with respect to how much return is realized or expected per unit of risk, measured on a scale of 1.0 to 4.3.

3. Security Type: Whether a security is an equity, fixed income, or another alternative classification.

4. Net Expense Ratio: The specific fee associated with a particular fund or ETF, expressed as a percentage in terms of every $10,000 invested.

5. Annual Dividend Yield: The trailing twelve months of regular dividends.

6. Equity Sector: Groupings of stocks or investments with underlying stock holdings with similar business activities, such as consumer cyclical, technology, utilities, etc.

7. Market Cap Size: There are three broad market cap categories: small, medium, and large. These classifications are based on the current market capitalization, which is the total dollar value of all outstanding shares of a company at the current market price.

8. Style: A portfolio’s equity exposure into value, blend, and growth based on the growth rate, earnings growth, EPS, and more.

9. Historical Annual Return: Annualized Return based on the compounding growth rate of the investment since inception or going back to 2004.

10. Max Drawdown: Observed loss in price from a peak to a trough of a security, before a new peak is attained.

11. Alpha: A measure of a particular security’s ability to create returns in excess of the measured benchmark.

12. Beta: Excess volatility as compared to the measured benchmark.

13. Standard Deviation: Annualized volatility since inception.

Sliders within the tool let you set your desired range for the first two criteria, Risk Number and GPA—because risk and return efficiency make up the foundation of every financial conversation.

From there, you can select additional search criteria, and much like Google does for your search engine queries, Discovery will crawl our database of over one million securities to display the most up-to-date results and data.

But that’s not all—Discovery’s Quick Filter option allows you to search for specific criteria without even taking your fingers off the keyboard.

For example, if you want to search for Risk Numbers between 40 – 80, you’d simply type in “Risk 40 – 80” or “Risk Number 40-80.”

Discovery currently recognizes roughly 35 keywords to set criteria for numeric and non-numeric filters, and over time, the algorithm will improve to help you set search criteria even faster.

Getting Started with Discovery

Whether you’re using Nitrogen Select or Nitrogen Elite, Discovery is now available in your account at no additional cost.If you’re not currently using Nitrogen, click here to schedule a demo with one of our experts today!

Discovery is continuing to get better each and every day, with even more exciting updates coming soon! Ready to get started? Learn how to favorite funds in Discovery.