Account Groups: An Upgrade Designed for Your Firm’s Efficiency

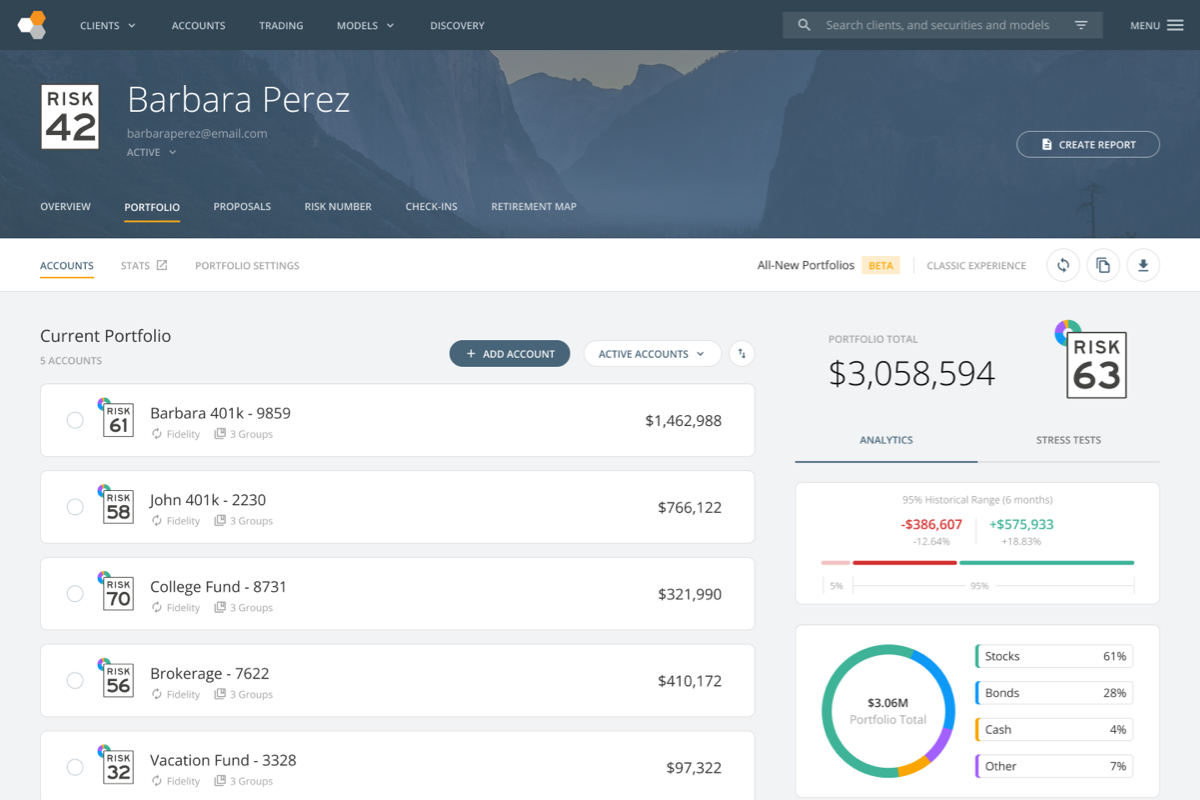

What is the All-New Portfolios Experience in Nitrogen?

At the 2021 Fearless Investing Summit, Nitrogen launched the All-New Portfolios Experience which has enhanced the way advisors navigate and interact with complex portfolios and accounts, driving efficiency in the day-to-day workflow for advisors across the platform.

The portfolio’s Risk Number, 95% Historical Range, and adaptive analytics are front and center, making it easy to set the right expectations with clients and prospects. Any time you select an account, you’ll see analytics for the Risk Number, 95% Historical Range, GPA, and more — all updated in real-time.

Introducing Account Groups

Now as fantastic as this portfolio page is, we knew we needed to make it even easier to organize and categorize your accounts in more useful ways.

Today, we’re announcing a big upgrade to the way you categorize your client accounts! The All-New Portfolios Experience now has Account Groups which helps financial advisors easily categorize all their accounts. This new feature will help you increase efficiency when working with complex portfolios and will make it even easier to find the information you need. We’re confident that Account Groups will optimize your workflow so that you have more time to spend where it matters most–with your clients.

That’s why we launched Account Groups to help you organize your client accounts. This powerful new feature will help you increase efficiency when working with complex portfolios and will make it even easier to find the information you need when meeting with clients. We’re confident that Account Groups will optimize your workflow so that you have more time to spend where it matters most–with your clients.

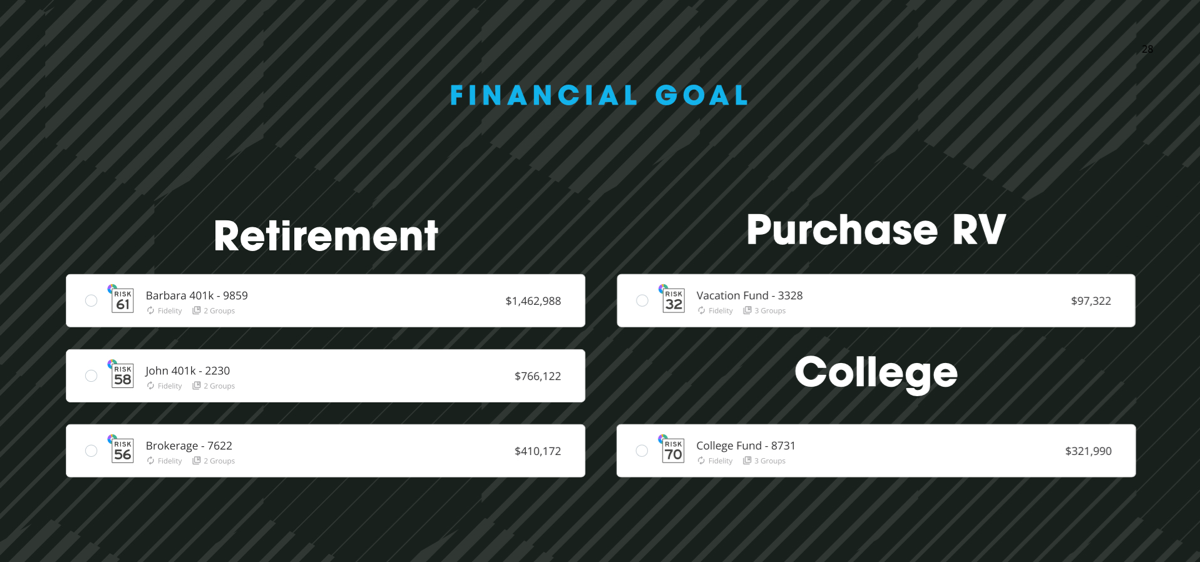

Perhaps you want to organize your client accounts within multi-client households — you can now easily do that.

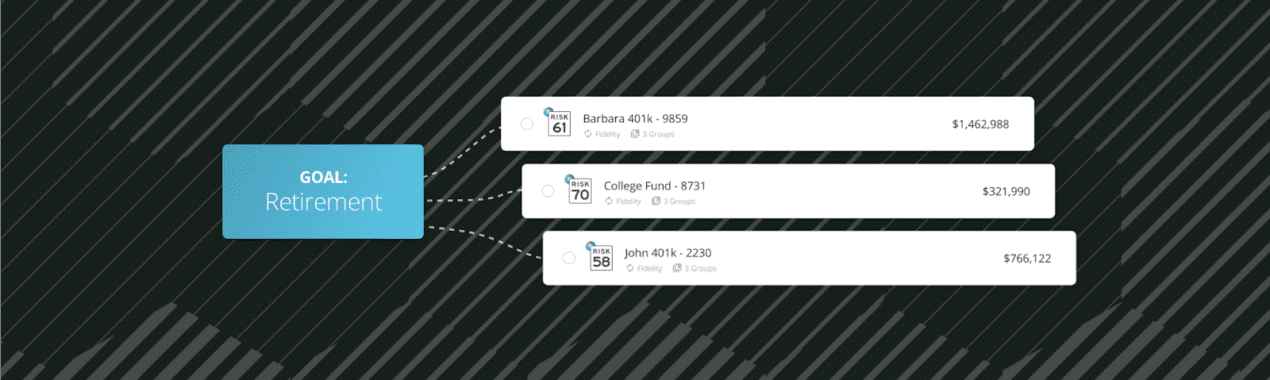

Maybe you want to organize every account based on particular financial goals like saving for college, buying an RV, or planning for retirement. The answer is one click away.

Perhaps you want to separate each account by time horizon, like 0-3 years, 3-10 years, and 10+ years. Easy!

We’re working to better aligned this feature with our integration partners. For example, the Orion platform has the concept of Portfolio Groups. We’re currently updating the integration so that your Orion Portfolio Groups automatically become Account Groups for you in Nitrogen.

No matter how you want to slice up your client accounts, we’re giving you the power to do it in the way that’s most effective for your workflow.

Account Groups is available today for all Nitrogen users on all plans.

Meet Your Support Team

If you have any questions or feedback, our team would love to hear from you at [email protected]. Interested in seeing how you can grow your business? We’d love to meet with you to see how we can support your goals.