The Billion Dollar Formula Part 3: Tools

In this three-part series, we dive into the workings of the billion-dollar RIA. We’ve included excerpts from our white paper, “The Billion Dollar Formula,” to show how billion-dollar RIA’s supercharge growth by adopting the right processes and right technologies for scale.

THE RIGHT TOOLS FOR THE JOB

If a firm hopes to actively manage thousands of clients and billions in assets, having the right tools is going to be essential. But starting out with billion-dollar tools (before you’ve reached a billion assets) doesn’t make sound financial sense. Technology needs change and evolve, and with fintech innovating year-over-year, solutions from 2009 might not meet your needs in 2019. The advisor technology landscape is vast, and with so many options, where does an aspiring firm start?

When considering the tools to manage clients, achieve scale, and improve efficiency, consider both the short and long-term:

- If my firm keeps growing at a predictable rate, will this technology need to be replaced before I have the budget to replace it?

- Will this technology integrate with tools I’m already using?

- Does this technology meet a need?

- Will this tool improve the client experience?

- Will this tool give me what I need to grow?

- How long will it take for users at my firm to understand and use this product?

- Does the technology empower me to incorporate my own capital market assumptions and/or brand?

- Does the technology appeal to both sophisticated and non-sophisticated clients?

- Will the tool tie in with my marketing and prospecting strategy/process?

A downfall for some firms is either not investing enough in their tech stack and sacrificing growth because there are too many inefficiencies, or choosing solutions that don’t have enough customizability to accommodate the firm’s needs. Competition in the marketplace means that advisors have the freedom to choose what’s best for their business at a price point that’s sustainable, without sacrificing essential functions. Another thing to consider—is this software revenue-generating or an overhead expense? The more revenue you can generate, the more a (slightly) higher cost may be worth it, especially if the features serve the firm well.

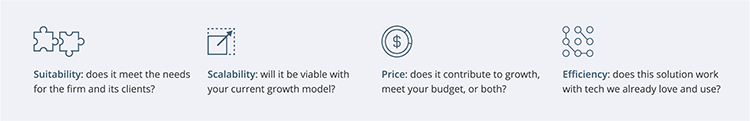

Advisor technology should be able to meet these criteria and answer these objections:

Collaborating with other members of the firm ensures that technology solutions are given the right consideration and implemented to offer the most value to the most people. Having organizational structures and assigned decision-makers is an important step for bringing in new tools. Taking too much time to implement solutions just increases practice inefficiencies.

Those looking to build a billion-dollar firm are often faced with a tough question: do we just implement an expensive, all-in-one solution that takes care of everything just okay and locks us in, or do we adopt multiple products and hope they talk to each other? Truthfully, it’s a little bit of both.

Several billion-dollar firms have TAMPs that manage a lot of core functions, but they also utilize other solutions and niche products for certain segments of their business. In order to become a billion-dollar firm, you’ll have to work with many different clients ranging from ultra-high-net-worth to young professionals. Technology that utilizes bps pricing and platform fees won’t always make sense for a $25K client, and flat fees or other low-cost options are a detriment for $5 million clients. Using the right solution for the right client adds to practice efficiency, so utilizing multiple products isn’t a downside. Being agile enough to know what strategies to use is a key trait for top-growth firms.

Portfolio management is often a high-stakes task that can make or break practice efficiency. A significant portion of advisors (21%) continue to create custom portfolios for each client instead of building model portfolios that can be modified. Unfortunately, creating an individual portfolio for each client is a time-consuming process that can impede the ability of the advisor to manage an efficient, scalable practice.

For the advisors looking to maintain the discretion of Advisors-as-Portfolio-Manager Programs, adopting model marketplaces can offer the ownership they want at the scalability they need. The flexibility of model marketplaces also opens opportunities for advisors to accommodate a wide variety of clients, as they can utilize the strategies of renowned asset managers at little upfront cost, rather than creating portfolios from scratch.

To read more of The Billion Dollar Formula, download our free white paper.