What is your website saying to your clients and prospects?

As your firm’s digital “home,” your website is a key piece of your firm’s marketing – more than two-thirds of consumers will look for a company’s website before visiting in-person.

The key to a great financial advisor website lies in your messaging. Specifically, it’s important that your site reflects your value proposition, both visually and through copy, to engage visitors.

In this guide, we’re exploring how you can attract and retain prospects via well-positioned website messaging based on your value prop – in just nine steps.

What’s Your Value Prop? 9 Steps to Compelling, Value-driven Messaging for Financial Advisor Websites

1. Understand your audience

The first step in honing the messaging for the best RIA websites is to think through who you want to attract to your firm. For many, this involves mapping out ideal client personas.

Client personas are fictionalized versions of the individual(s) you would most like to work with and why. From there, you can focus in on the problems that would drive your persona(s) to need your services in the first place, how you can solve those problems and what marketing tactics would work best.

Rather than using marketing that casts a wide net and speaks to no one in particular, personas allow you to talk directly to the individuals that would be a best-fit for your firm.

And you can never go too in-depth with these imaginary clients – great client persona will include everything from demographics to lifestyle choices, and some businesses even give their personas names!

Actionable Step: Develop one to three ideal client personas

To begin, sit down and brainstorm three core questions:

- What do your favorite clients look like? Think about the clients you’re most excited to serve – it’s okay to have more than one, but it can’t be “everyone!”

- Why do those clients need your firm? Write down the obstacles those people most often encounter in financial planning.

- How can your firm reach those clients with the right services at the right moment? Consider how would each of your personas begin their search for a solution – what are they Googling? Who are they reaching out to?

Knowing the answers to these questions will help you find messaging that resonates and attracts the right kind of prospects.

2. Find your differentiator

There are an estimated 330,000 financial advisors in the United States as of 2021 – that’s a lot of competition.

Luckily, no two advisors are exactly alike! Finding what sets you apart from the masses can help you develop messaging for a wealth management website that keeps prospects engaged and interested. That differentiating factor could be a part of your approach to investment management, communication style, the types of clients you work with or something else entirely.

Perhaps your background in the medical industry has given you specific insights into the lives of doctors and nurses, or your taste for adventure makes you the go-to for retirees who love to travel.

A great example of this is Colton Etherton, also known at the Tattoo Artist Advisor, whose passion for the arts has led to a career primarily focused on solving financial problems for tattooists.

Actionable Step: Find your strengths

Start by listing out all your planning services, resources, tech tools and philosophies. Do you provide estate planning services or aid in tax preparation?

Then, make a list about yourself: your educational background, favorite places, hobbies, and more – while it may not seem obvious at first, your true differentiator could be where these two lists overlap.

As you make your lists, circle anything that you think might be an extra value-add to your clients, a special skill or extra service. Take that brainstorm a step further and think through how those three things could specifically benefit your client personas.

3. Distill your messaging

After accomplishing the above steps, you likely have a stack of notes, lists and imaginary clients – now what?

It’s time to weed through all that information and pinpoint your messaging. The goal here is to find words or phrases that speak to the heart of your services (i.e., your value proposition), which you can then incorporate into a website for a financial advisor.

Think about it this way: Your prospects don’t want to read a novel just to find out what you do – they want to know immediately what you’re bringing to the table.

Actionable Step: Write, delete, repeat

Write out your value proposition in 100 words or less. It’s okay if it’s not pretty quite yet – you can always revise. The purpose of this exercise is to narrow down all that information to just the absolute necessary: Which things are you willing to hit “delete” on, and which words are absolutely essential for your prospects to know?

Then, see if you can get all of that down to one sentence or tagline – you may even find header ideas for your website!

4. Revise your homepage

Did you know that it takes just 50 milliseconds for someone to form an opinion of your website?

With less than a second to make an impression, it’s vital to have a homepage that wows without being overwhelming. Research suggests that short and engaging copy is the way to go, with one recent report stating that anywhere from 100 to 1,000 words on a homepage is a good range, but 400 to 600 is optimal.

You should also pay attention to the size and placement of the text on your homepage. Make use of various sized headers, bolded text and easy-to-read fonts to guide the viewer’s attention down the page.

Actionable Step: Host a brainstorm session

Gather the core members of your team to look at your homepage together and gather feedback. Are you getting that value proposition right away? Is there too much or not enough content?

If there’s more than 1,000 words on the homepage, it may be a good idea to think through what could be cut.

5. Remember your “why” – and add it to your site

Your journey – and your firm’s background – can help create an emotional connection and build trust with site visitors. It humanizes your firm, giving it a face and a narrative that people can relate to while also providing an opportunity to reinforce your value prop.

Of course, that doesn’t mean you have to tell every detail of your life – content throughout your website should always be crafted with user functionality in mind, so make it scannable and add headers where it makes sense.

For example, Nitrogen’s “About” tab gives you a brief overview of our mission, with a CTA to learn more about our core values. As you scroll down, you’re invited to learn more about each member of our team, including a brief biography, their favorite Nitrogen value and a fun fact. The content here gives prospects a look at each individual, as well as how and why they’re supporting our core value proposition of empowering others to invest fearlessly.

Actionable Step: Look at your “About” page

If you haven’t already, create or revisit your “About” page and add some context to your practice: Share your journey, your mission and the passion that fuels your work. Much of this can (and should) align with your value prop.

Whether it’s a personal experience, a vision for a better financial future, or a commitment to ethical investing, let your “why” shine through.

6. Use visuals that support your message

Humans are visual creatures, so the financial planning website design and photos you use matter just as much as the copy and taglines you’ve chosen.

Consider what aspect of your services or philosophy you want to emphasize. If your value proposition centers on providing unparalleled customer service, incorporate images that showcase interactions between your team and clients. If technology is a key focus, use visuals that highlight your cutting-edge tools and platforms. Alternatively, if your message revolves around local roots, feature images of your team in the community or iconic landmarks.

With that in mind, there are a number of stock photo websites you can use to browse for photos (such as Pexels and Unsplash). You can also work with a local photographer or even hire a graphic designer to help you customize your website’s look.

Actionable Step: Revamp your visuals

Take stock of your site’s current imagery and make changes as necessary. Feeling a little out of your wheelhouse? Consider reaching out to a website designer for input or inspiration.

7. Build credibility

You know your value proposition, and you’ve built the right messaging, but how do you get website visitors to really believe you?

Awards, testimonials and case studies show site visitors that you have a trustworthy reputation and invite them to learn more about your services – it builds “social proof,” or credibility based on feedback from others. Some of the top financial advisor blogs on the web today publish articles aimed directly at filling the credibility gap.

In the financial services industry especially, that credibility and trust are essential, and demonstrating that you have a track record of success and satisfied clients goes a long way in building confidence with potential clients.

As you choose which pieces of social proof to include on your site, keep your overarching goal in mind – which speak directly to your value proposition?

It’s also important to keep compliance in mind considering the recent SEC Marketing Rule updates.

Actionable step: Make room on your homepage for those award icons.

If you get the okay from compliance, it’s a good idea to place some client testimonial quotes on your homepage (especially any that touch on your value prop). You can also consider linking to a page dedicated to case studies for further social proof.

8. Offer educational content that reinforces your expertise

Don’t just talk the talk – show off your value with educational insights and resources for your prospective clients.

Grace Bryan, Corporate Marketing Manager here at Nitrogen, puts it into perspective:

“Content marketing encompasses so many different kinds of thought leadership content from digital content, promotional content, white papers, ebooks, podcasts, videos, etc. It really serves to build trust with your audience.”

As you develop your financial advisor content library, consider what questions your clients and prospects ask most often. For instance, if your firm specializes in retirement planning, you could create content that addresses the unique challenges and opportunities retirees face. Provide practical tips, industry insights and actionable strategies to position yourself as a trusted source.

Actionable Step: Create consistent content

Start by developing a content calendar that outlines the topics, formats, and publishing schedule for your team. Align these resources with your areas of expertise and your value proposition to drive impact.

9. Monitor, measure and make changes as needed

When you make changes to your site, it’s important to measure their effectiveness.

Aside from gathering feedback from clients, you can also use analytics tools to track how many visitors are on your site, how long they stay on each page, etc. From there, you’ll have a better idea of what messaging is resonating most.

Google Analytics is one of the most popular tools available, and they even offer free, self-paced resources and classes to help you get started.

As you dive into analytics, pay particular attention to metrics related to your value proposition. Are visitors spending more time on pages that highlight your unique strengths? Are they engaging with your educational content? Use these insights to make data-driven decisions about refining your messaging and optimizing your website for maximum impact.

Actionable step: Set up Google Analytics

Set up Google Analytics to monitor and measure the impact of your messaging changes, but keep in mind that it could take several months before you see new marketing tactics really move the needle. If you’re trying something new, set a reminder to check in on the data in a month or two.

Bonus tip: Leverage the Nitrogen Advisor Marketing Kit

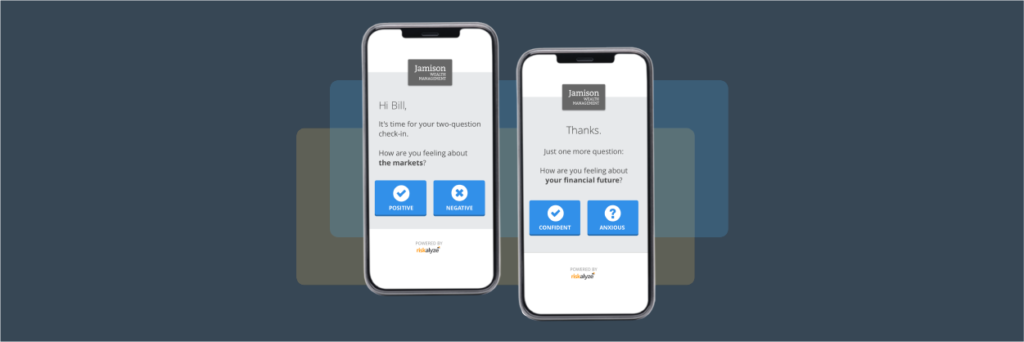

Nitrogen’s wealth management platform includes the tools you need to craft compelling marketing and messaging for your site. With our Advisor Marketing Kit, you can easily create:

- Personalized, client-facing videos

- Presentation templates

- Brochures and press releases

- Print items with free delivery

- Online advertising campaign

- And more

All of these tools are branded and positioned to reinforce your firm’s value and create a more engaging digital experience for prospects and clients.

Remember, effective communication of your value proposition is not a one-time task but an ongoing process. With these nine steps in mind, you will be well on your way to creating one of the best financial advisor websites on the internet today.

Get Started with Nitrogen

Looking for ways to attract, engage and win over prospects? We can help. Click here to connect with a member of the Nitrogen team today. Read more about how to grow your financial advisory business and enhance your marketing through our complimentary High Growth Playbook.