Amidst unprecedented market volatility, financial advisors are under more pressure than ever to build client trust and maintain relationships. Not only do they need to be aware of the market conditions and how they will affect investments, but they also need to be able to understand client psychology to meet their clients’ needs.

At Nitrogen, we’re proud to offer a powerful tool to help advisors immediately understand how their clients feel, changing the game for thousands of advisors. This year, we decided to make Check-ins even more accessible and actionable for advisory firms entering an uphill battle to satisfy clients despite a market downturn and looming recession.

What is Nitrogen Check-ins?

Check-ins is a powerful tool that allows you to build a strong foundation to support your message between client reviews and give you an early warning signal when a client’s psychology might need a little care.

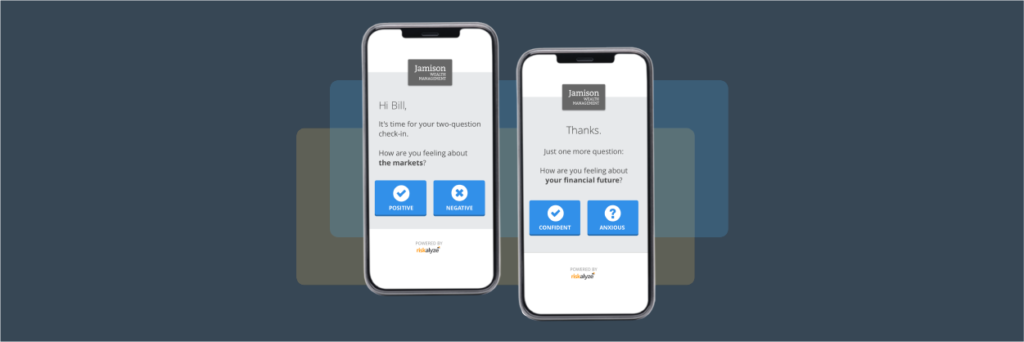

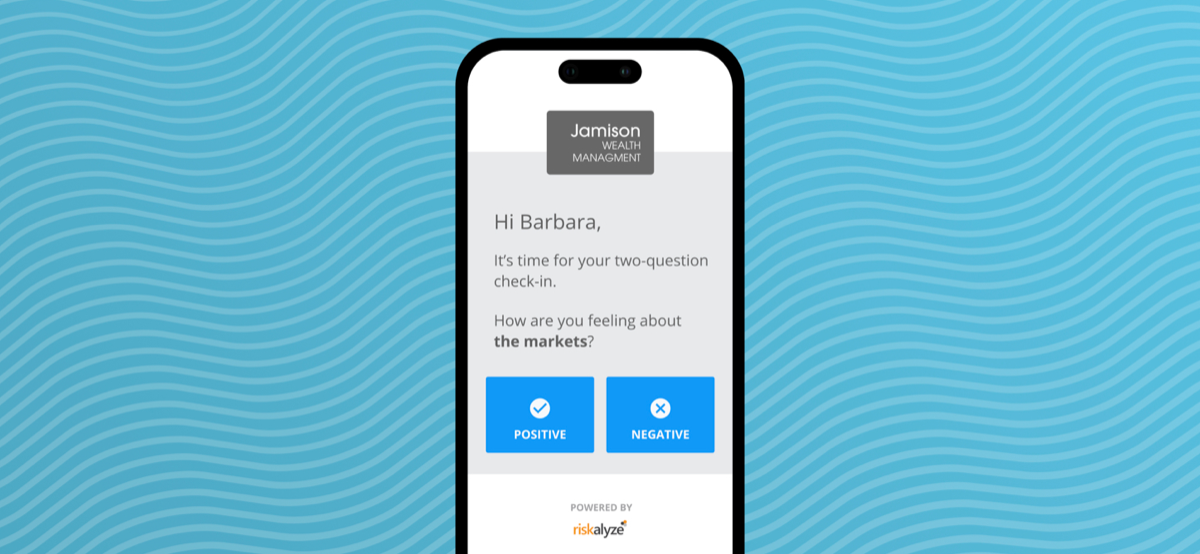

From the client overview page, it’s as simple as clicking “Send Check-in” and having that email land in your client’s inbox, allowing advisors to ask their clients two questions:

- How do you feel about the markets?

- And how are you feeling about your financial future?

Clients can quickly answer these questions from any device with just two taps. After that, they’ll see adaptive analytics explaining what’s ‘normal’ for their portfolio.

Consumer Research on Market Sentiment

Since the 2020 pandemic, there’s been a considerable spike in the number of advisors using Check-ins on a monthly or quarterly basis with their clients. It’s incredible how effective it is to sift out which clients need your attention and which ones are doing okay.

“I love these Check-ins. I sent them out and got over 50 responses! I heard back from clients that normally won’t respond to anything I send them.”

– Shawn, Advisor

Check-ins is like CLIENT RADAR. I would pay for Nitrogen just for this one feature!”

– Jimmy, Advisor in Texas

With Check-ins, Nitrogen has captured more than one million data points about how investors feel about the markets and their finances.

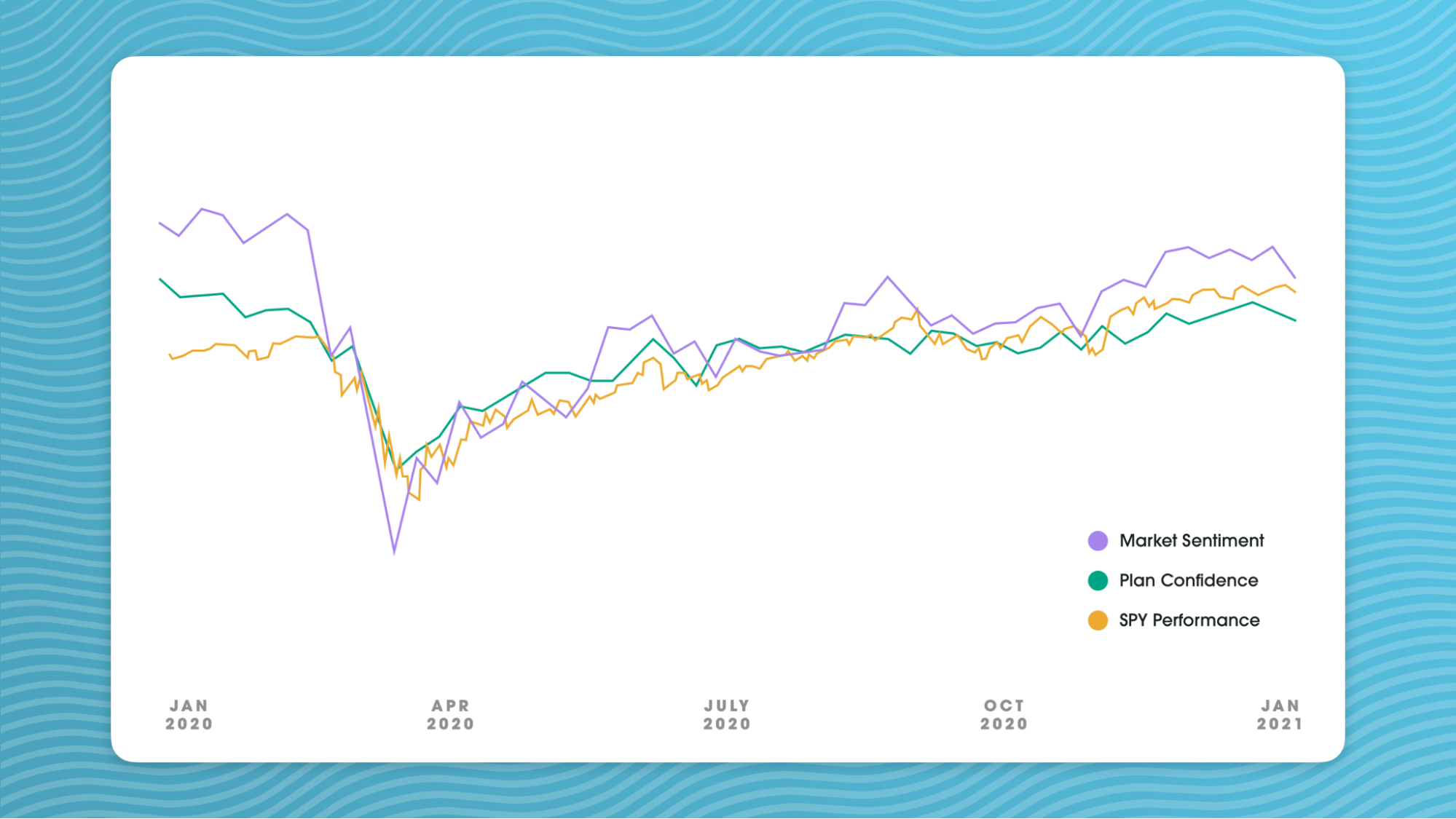

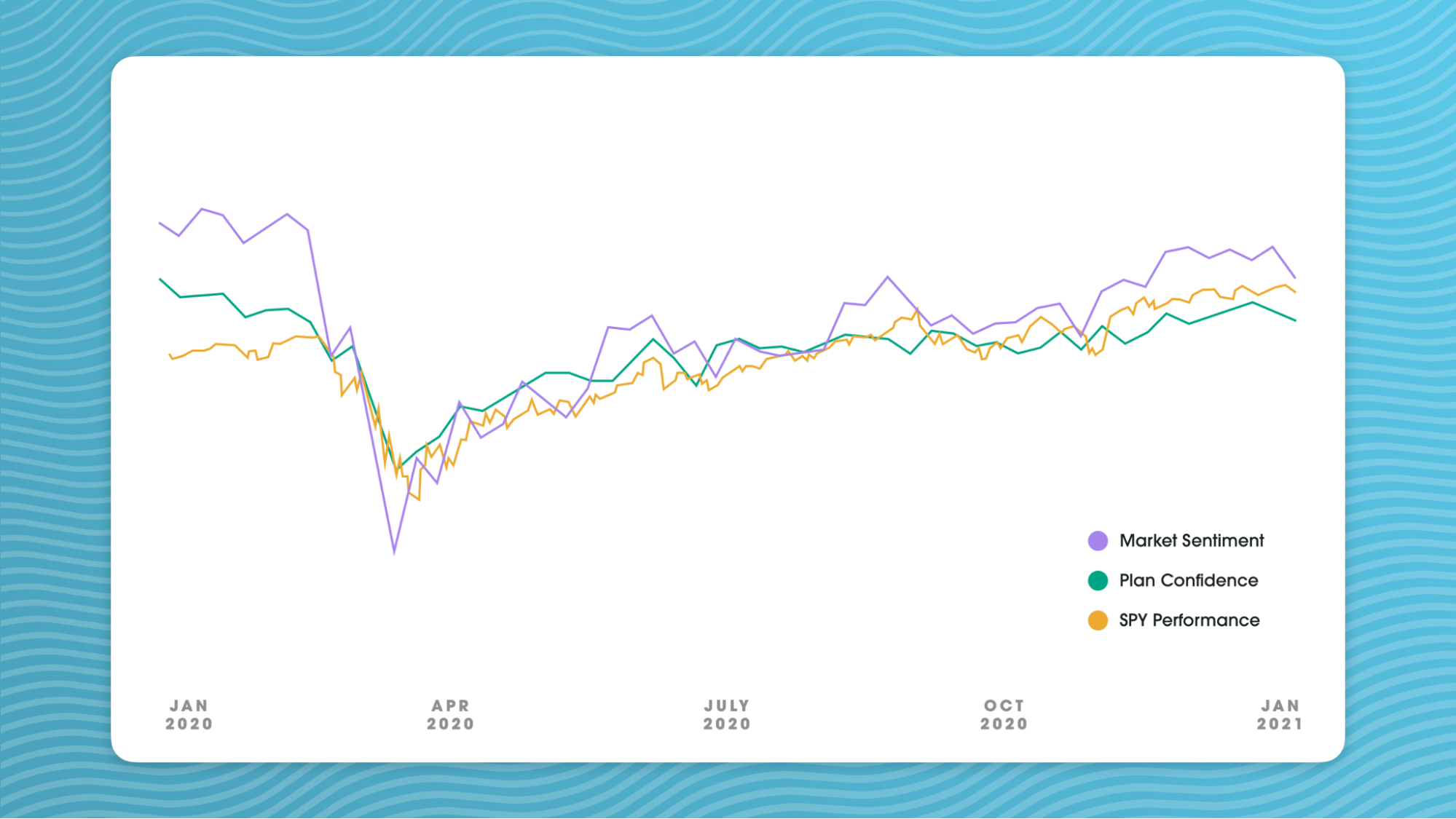

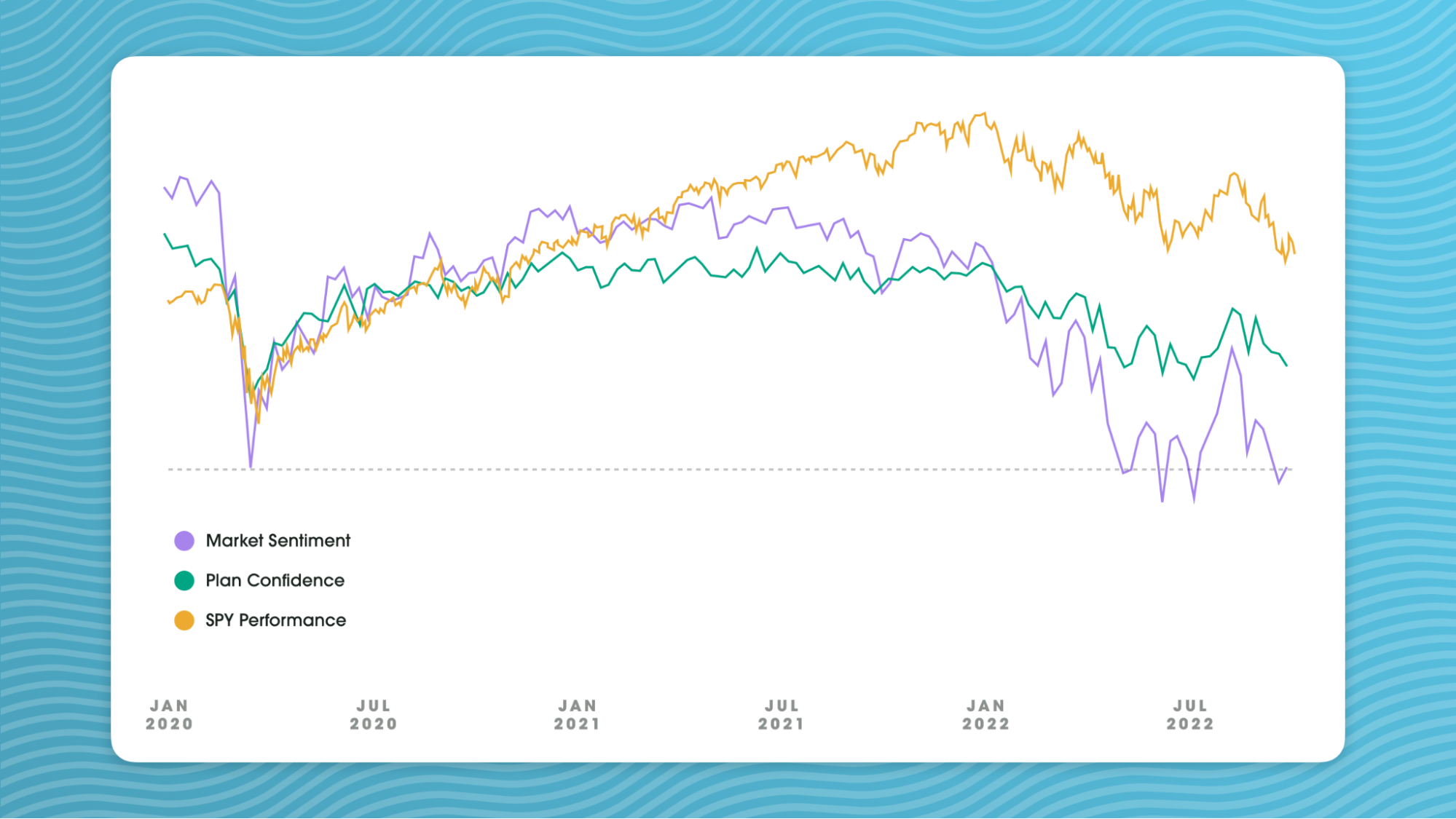

Pictured (below) is a combined view of all the investors tapping on these Check-in questions in 2020. Market sentiment is in purple, and plan confidence is in green. Orange shows what the S&P 500 was doing over the same period. The stock’s performance is tightly correlated with aggregated market sentiment.

Note that before the pandemic, it was normal for plan confidence to be lower than market sentiment. When markets are up, there will always be investors wondering, ‘Why is the market beating my portfolio?’ in the good times. That gap briefly inverted during the pandemic and, by the end of the year, had flipped back to its normal state.

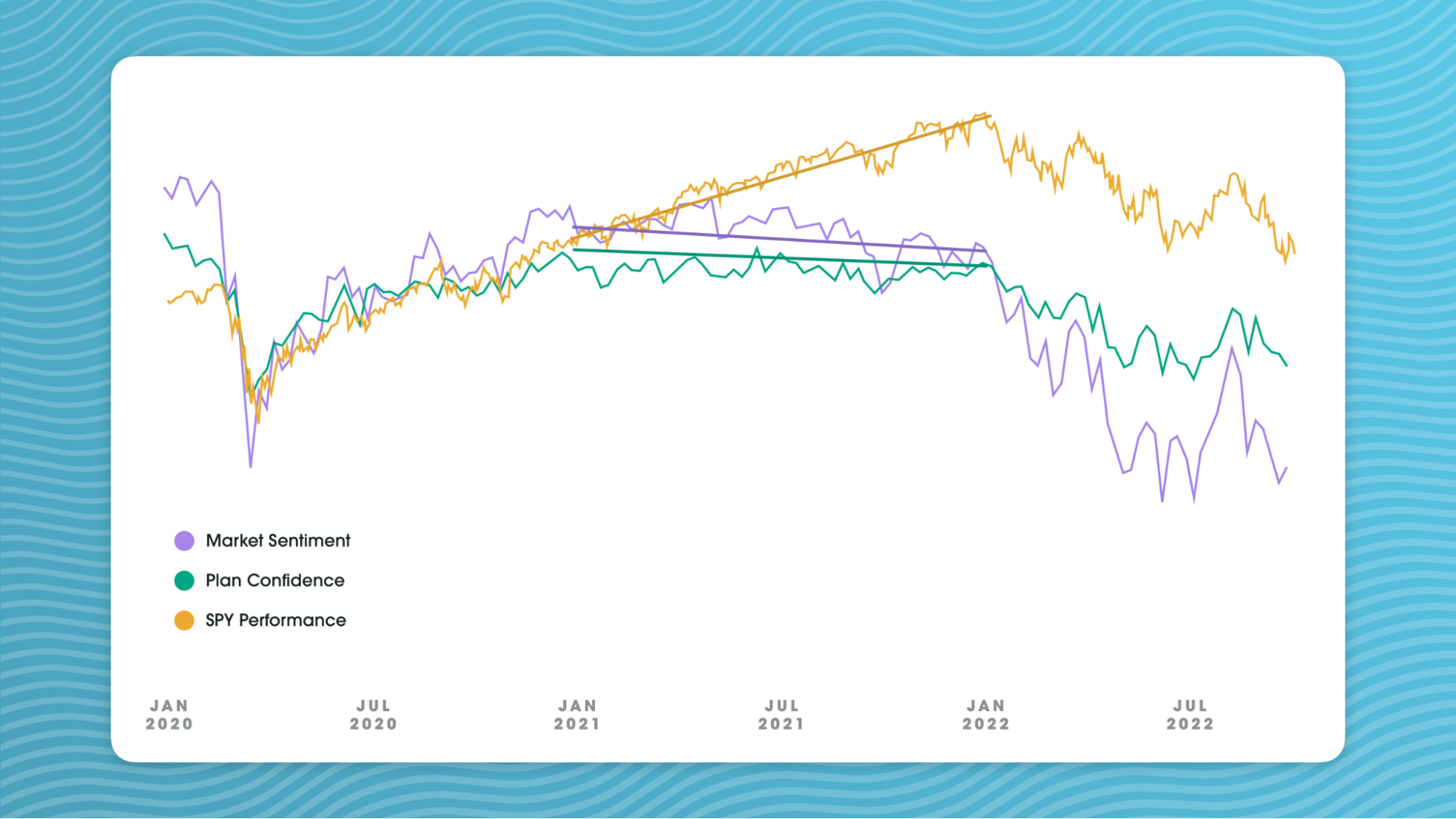

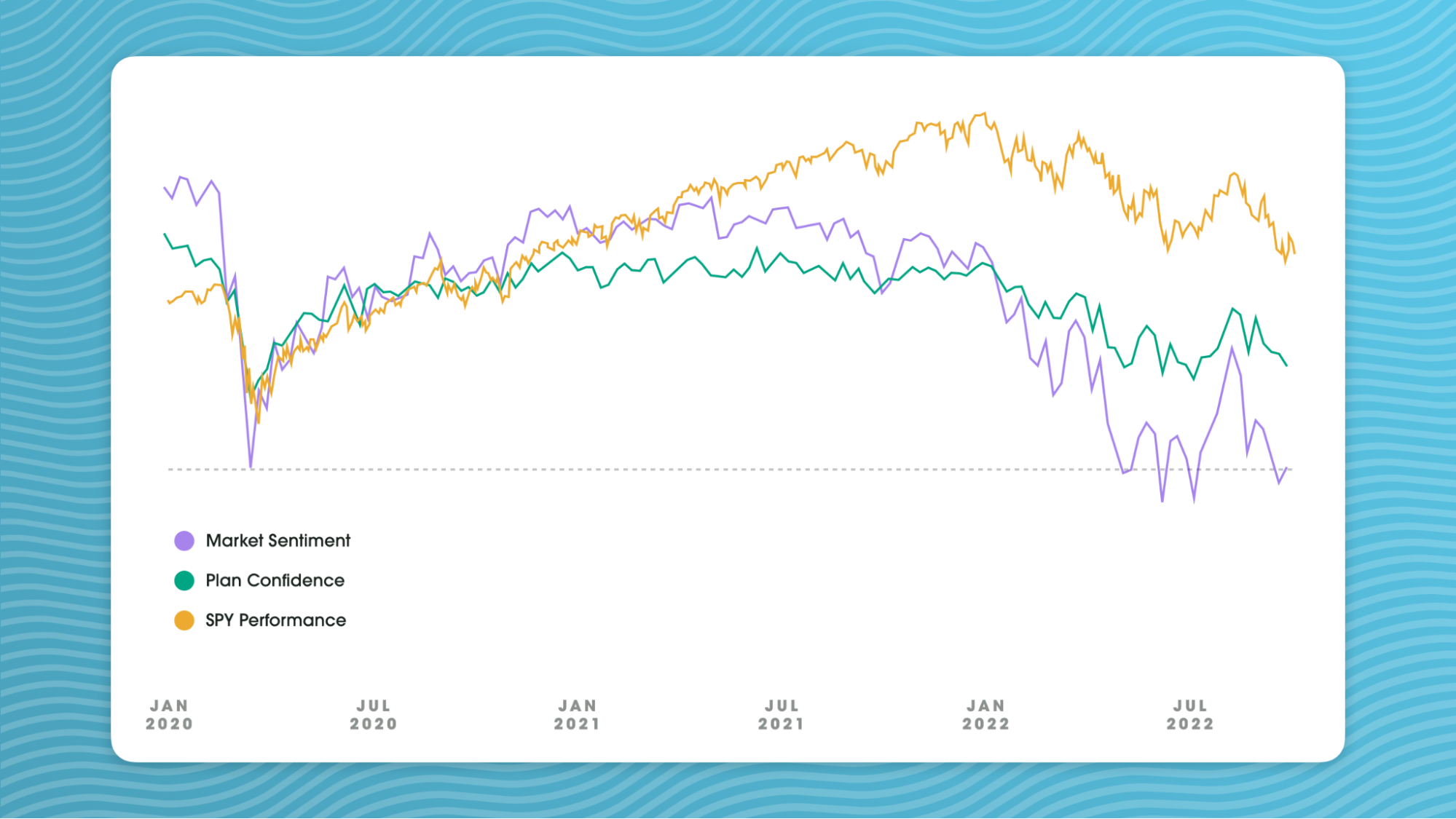

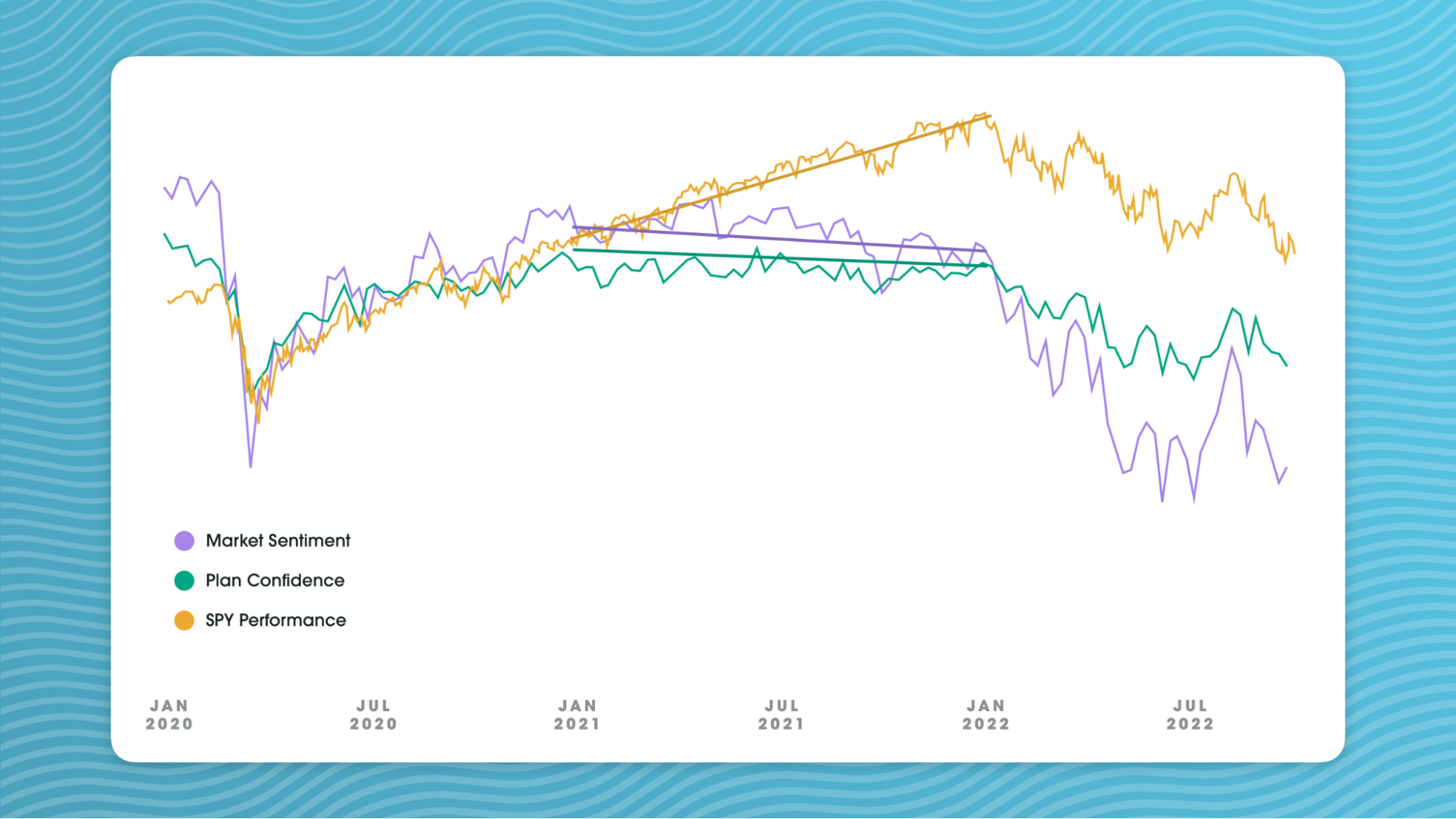

However, the pandemic created a shift in investor psychology and increased anxiety. When you look at 2021 and 2022 (pictured below), market sentiment plateaus even as SPY continues to rise.

In 2022, market sentiment dips below the low point of the 2020 pandemic crash. To investors, sustained inflation seems to be worse than the pandemic crash.

Plan confidence has stayed well above market sentiment for clients who know their risk number.

Making Check-ins More Actionable

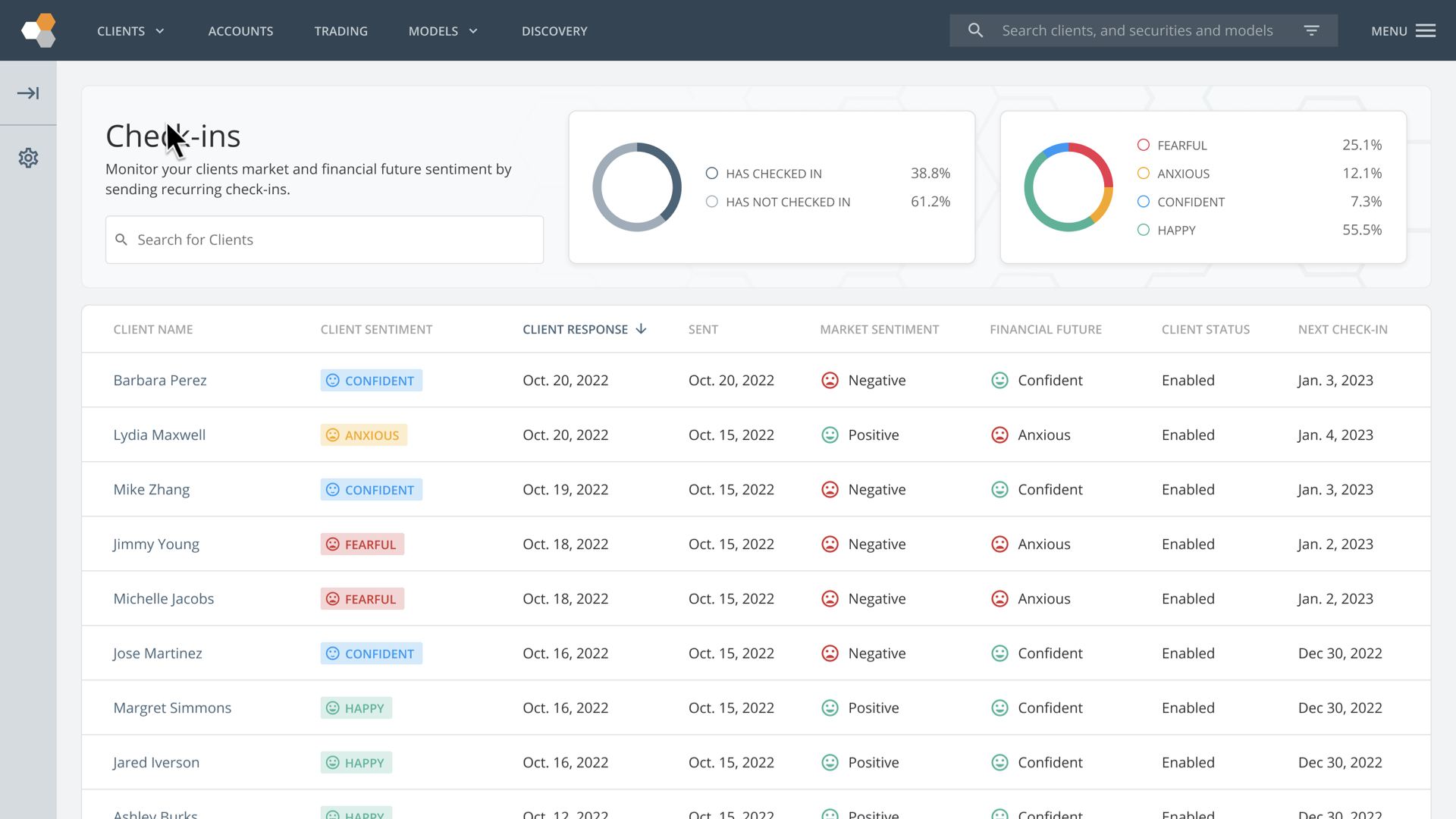

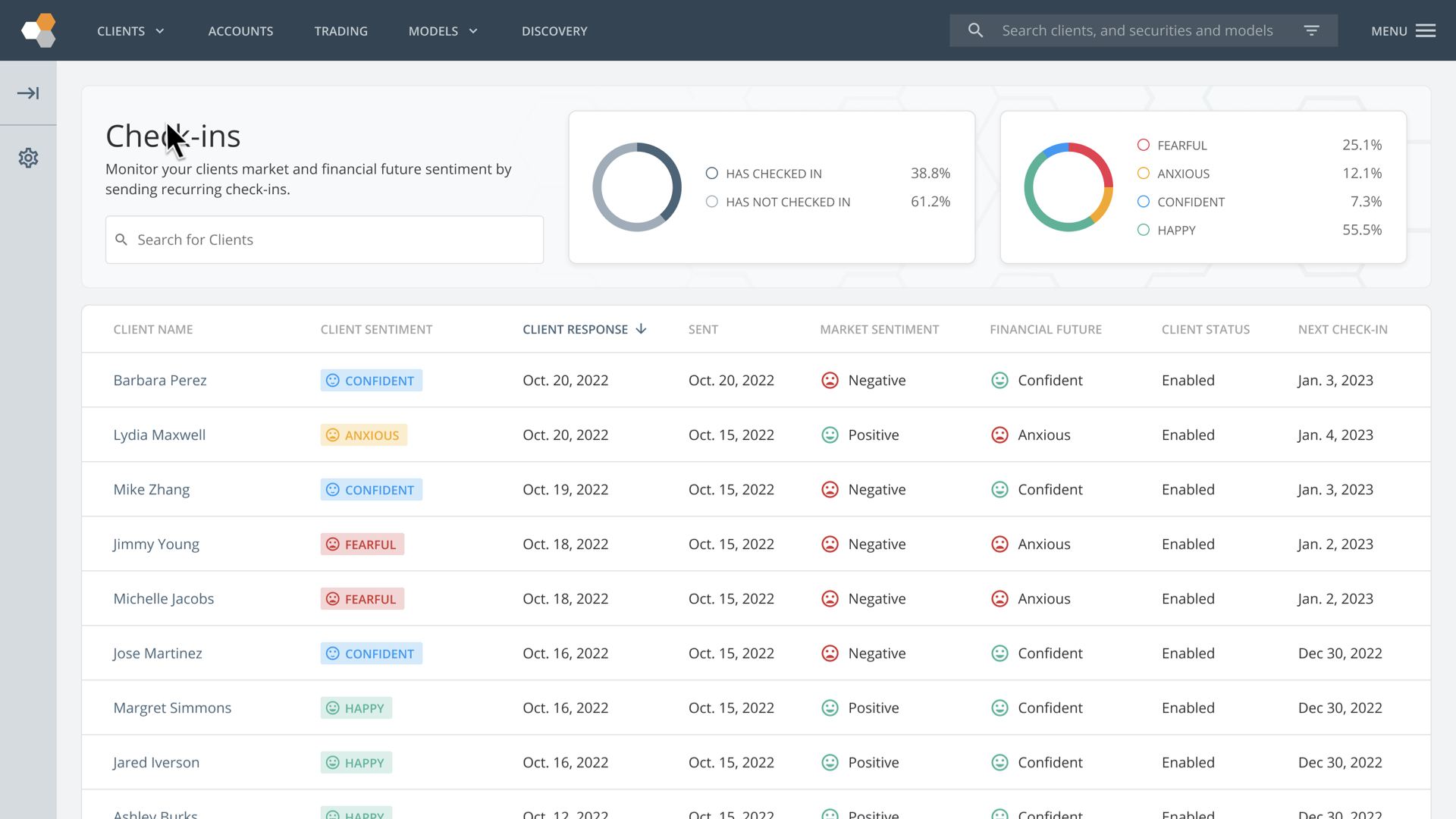

Because advisors love using Check-ins, we’ve rebuilt the experience to make Check-ins more accessible and actionable whether advisors are Check-ins experts, or using the tool for the first time. This powerful, new update will help you immediately comprehend how your clients are feeling (both individually and collectively) and see which clients you may want to follow up with based on their responses. We are also implementing a Search and Sorting functionality of the clients list so you can search for your clients and sort by their responses easily.

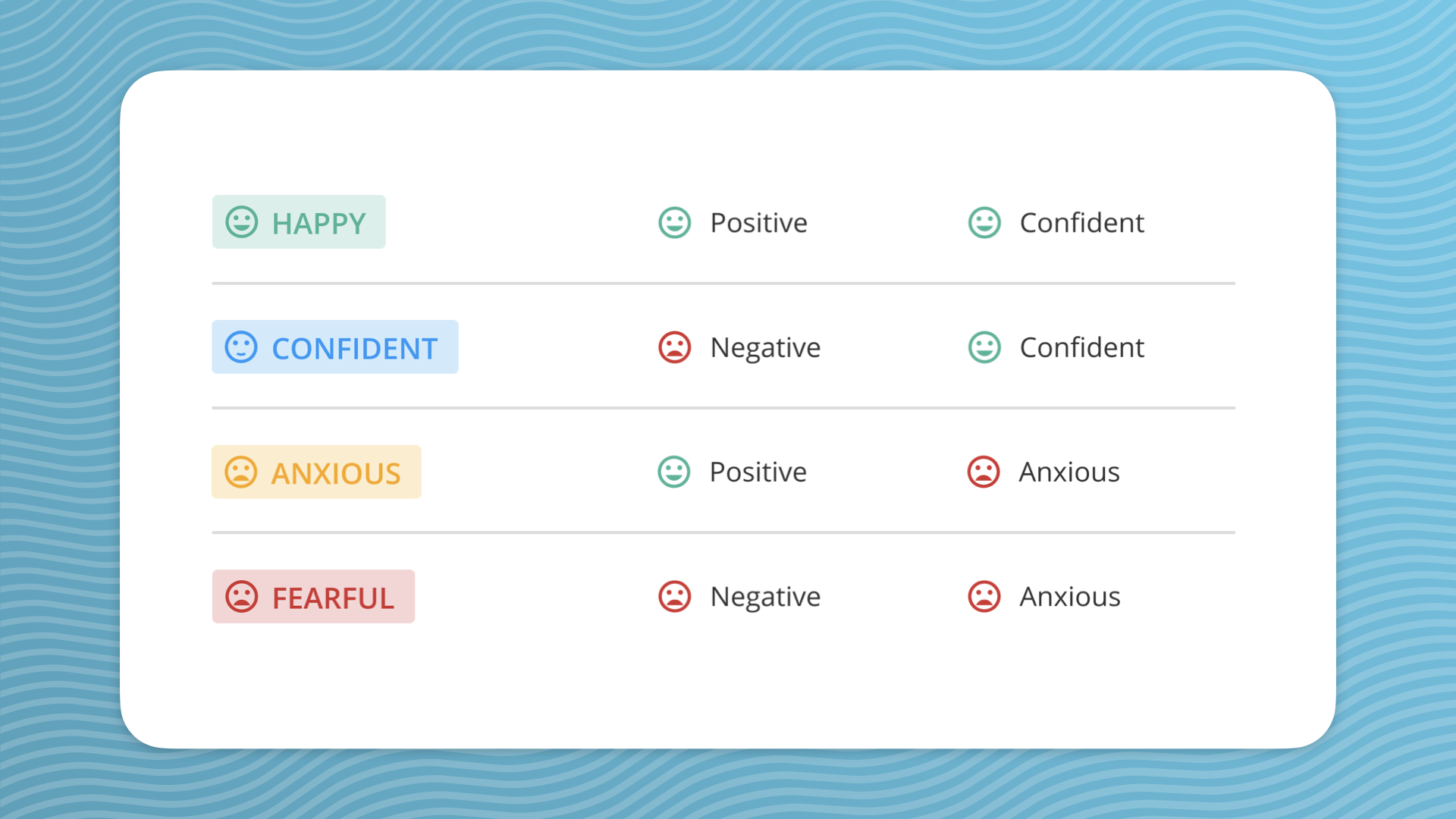

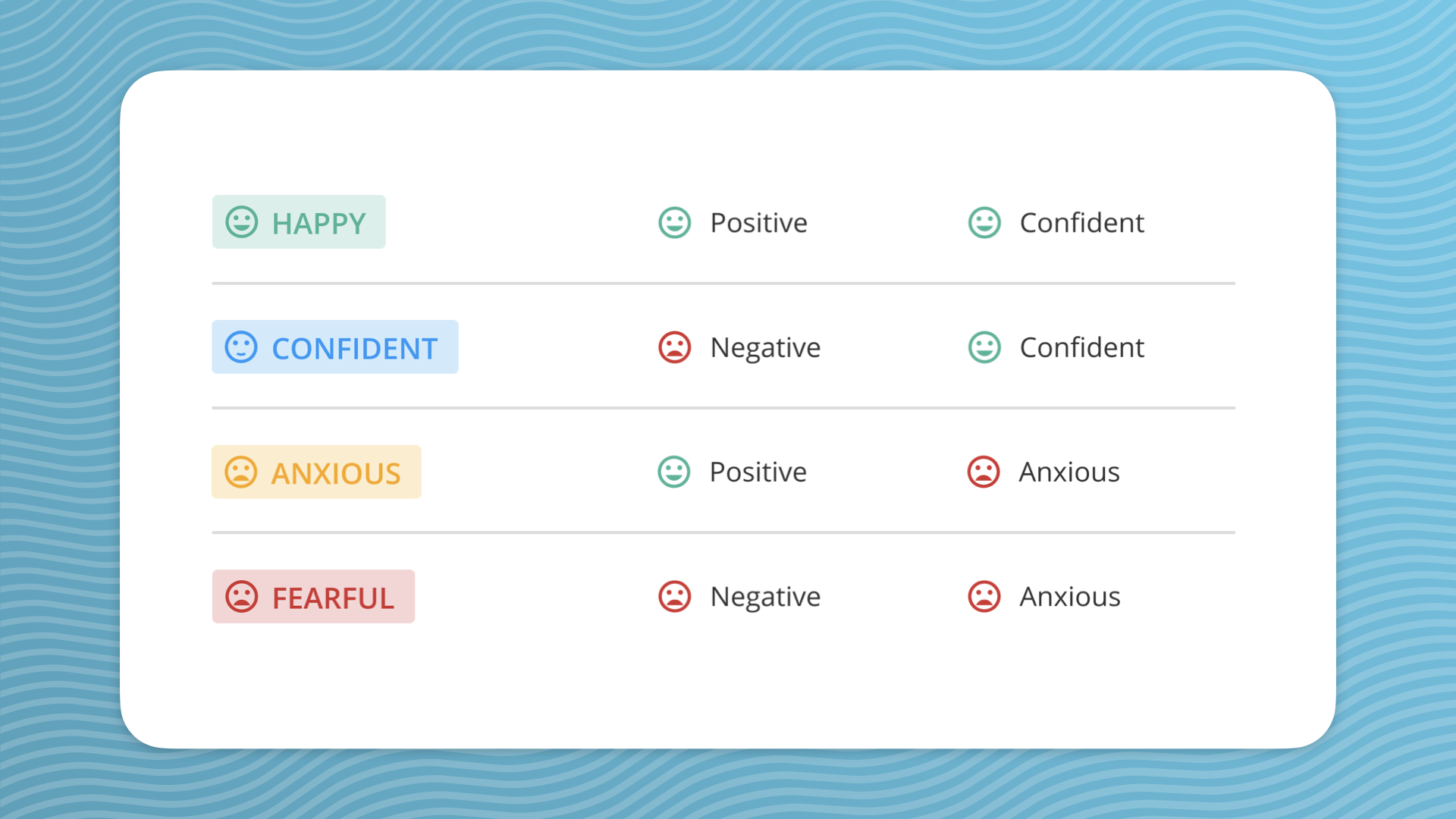

Client Categorization – Our product team has been hard at work building four new client labels that are going to make it even easier for you to take action when a client checks in — Fearful, Anxious, Confident, and Happy.

Fearful clients responded negatively to both questions. Not only are these clients worried about the market, but they also aren’t feeling confident in their financial plan. And most of the time, it’s these exact clients that have a Risk Number that is out of alignment with their current portfolio! It’s no wonder they are worried about market volatility and calling or emailing you every week asking, “Are we okay?”

Anxious clients might not be worried about the market, but they are feeling a little nervous when it comes to their financial future. Oftentimes, we notice these are the clients who have a Risk Number slightly above or below their current investments. This is usually an indicator that a slight tweak or update to their portfolio might bode well for this client relationship.

Regardless of how the markets are doing, Confident clients feel confident in their financial future. And this is because you’ve taught them to understand their Risk Number and 95% Historical Range. It’s these clients who understand the value you bring.

Lastly, Happy clients are feeling positive about the market and about their financial future. These are clients who believe in your advice and the power of the Risk Number, and understand that you’ve set them up for long-term success.

New Table View – From the new table view, you can select any client and see all of their Check-in history. This empowers you as their advisor to see how they’ve been feeling about the markets and their financial future over time.

Check-ins is a powerful way to check on the pulse of every single client within your firm and know when a client’s psychology might need a little care. These powerful features are going to revolutionize the way that your firm engages with clients and ensures that clients feel confident in their financial plan.

These new features are available TODAY for all Nitrogen users on every plan. Don’t hesitate to reach out to our team at [email protected] if you have any questions or feedback.

Watch Nitrogen CEO, Aaron Klein, walk through the new Check-ins updates from the 2022 Fearless Investing Summit Stage below.

Haven’t got Nitrogen? Book a Demo today to see how Check-ins can transform your business by helping you grow client relationships in any market conditions.