THE #1 RISK TOLERANCE QUESTIONNAIRE IN WEALTH MANAGEMENT

Quantify an Investor’s Risk Tolerance

Our Risk Assessment is built to quantify a client’s risk tolerance in less than 5 minutes. And the beauty of it lies within its adaptive, dynamic format. Using real dollar amounts, each question builds off the last to make a truly interactive experience.

The Old Way of Assessing Risk Just Doesn’t Work

Stereotyping investors by age doesn’t work; 52% of 20-29 year-olds aren’t “aggressive,” and 53% of 70-79 year-olds aren’t “conservative!”

Insider semantics like “moderately aggressive” are subjective in nature and mean something different to each client.

Assessing market sentiment alone attempts to pin down a moving target that will never ever tell the whole story.

Hypotheticals that aren’t tied to real, relevant dollar amounts won’t get to the heart of someone’s risk tolerance.

Legacy questionnaires leave clients overwhelmed, confused, and full of bad expectations.

Generate leads using our award-winning Risk Tolerance Questionnaire

Not only does Nitrogen help you win new clients by analyzing a prospect’s statement; we also help you generate new leads! Advisors can easily embed a version of our risk tolerance questionnaire into their site, and use it to generate new leads. (Fun fact: The average Nitrogen advisor gets 28 leads through this feature!)

Each time a lead completes the questionnaire, Nitrogen will send you an email notification. You can then log into Nitrogen to review their contact information, Risk Number details, and start building a plan, all before your first meeting!

Putting the Risk Number into action

Whether your client is across the room or across the world, you can send them a link and walk them through the assessment from start to finish.

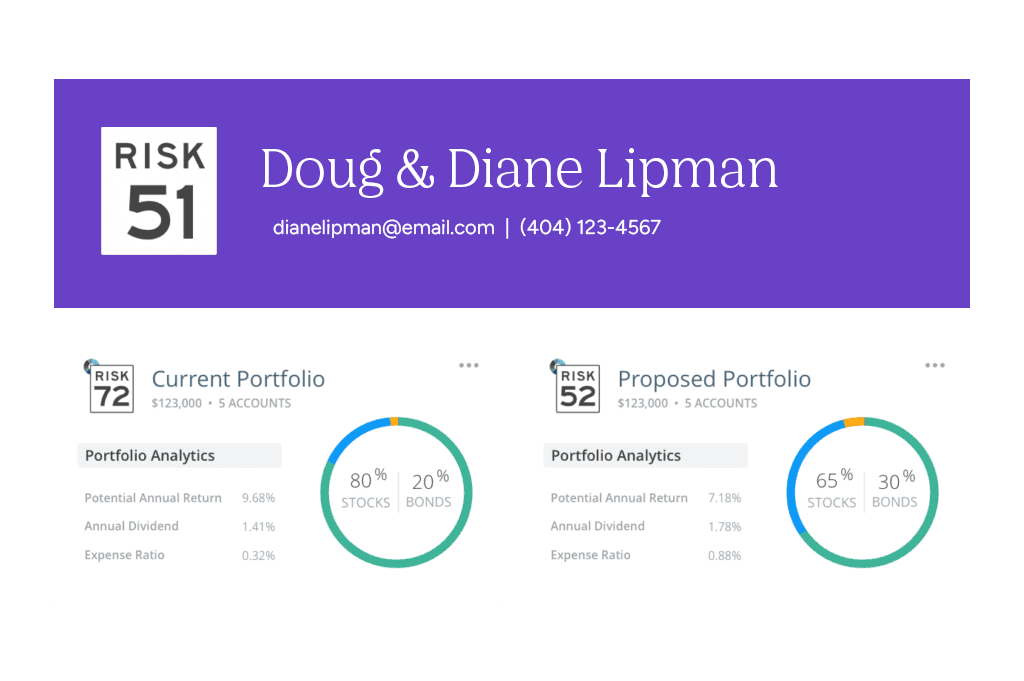

Once completed, Nitrogen generates their Risk Number® on a scale of 1-99, utilizing a scientific framework that won the Nobel Prize for Economics. The Risk Number is an objective, quantitative measurement of an investor’s true risk tolerance and the risk in a portfolio.

When clients know their Risk Number, they know you’re acting in their best interests. And these assessments are time-stamped and archived, giving you the confidence that you know your client and can prove it quantitatively.

After all—you didn’t tell them they’re a 42. They told you they’re a 42.

“Because of the Nitrogen questionnaire, I’m bringing in more business than I can keep up with! I haven’t seen growth like this in the 20+ years I’ve been in the business.”

JAY, ADVISOR IN PENNSYLVANIA

SCHEDULE A DEMO

Ignite firm growth with Nitrogen

Let one of our experts guide you through the Growth Platform, answer any questions you may have, and show how thousands of firms like yours have found success with Nitrogen.