Volatility Notes from the CIO

By Michael McDaniel

Co-founder and Chief Investment Officer

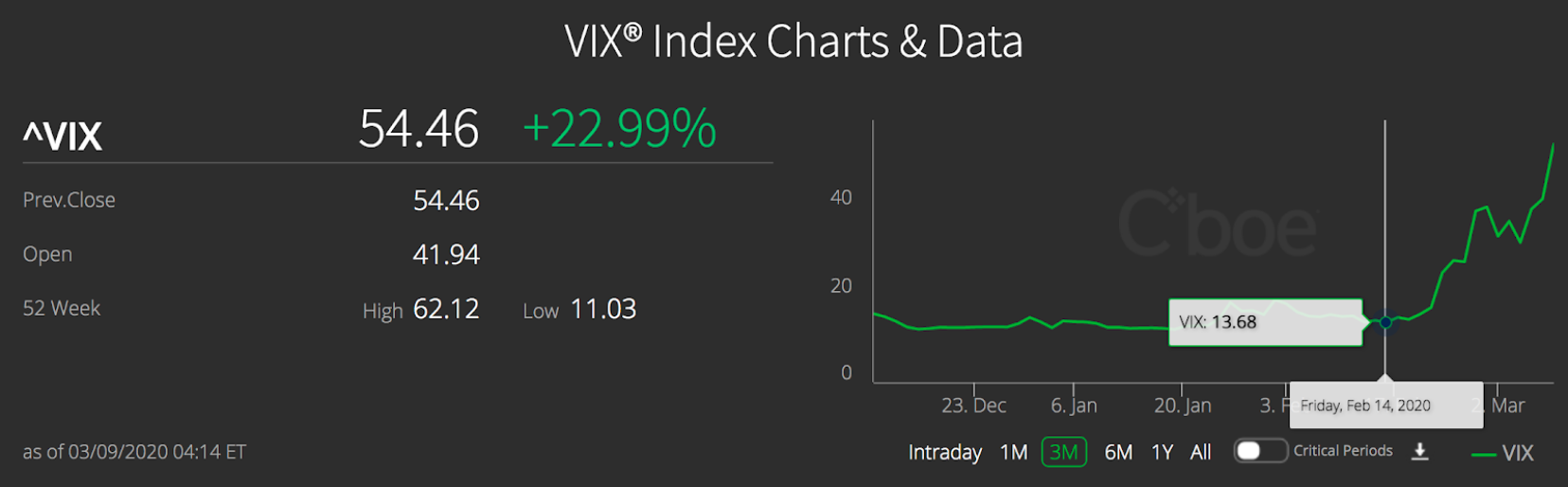

The Cboe Volatility Index® (VIX® Index) finished March 9, 2020 at 54.5. Sixteen trading days ago, on Valentine’s Day 2020 the VIX was at 13.68.

By now you are aware of all the uncertainties inherent in the markets. A slowing global economy, a swift drop in the price of oil courtesy of Russia, a panic interest rate drop of 50 basis points by the United States Federal Reserve, and a potentially debilitating pandemic. Pick your narrative(s). Is the China trade deal still a thing? I digress.

Hopefully, you’ve proactively incorporated Nitrogen’s quantitative approach to getting risk right in your practice. We’ve preached proactive best practices during the good times to help advisors set individualized expectations with clients so that wild market environments like this don’t empower decisions based in fear.

Aligning client Risk Numbers with the right holdings is how great advisors empower their clients to invest fearlessly. Check out our “Expectations Are the Root of All” or “What to Do in a Bull Market” blog posts about setting client expectations. Both were written during the tail end of the recent bull market.

In spite of the wild market action, a handful of our partners have delivered on their mandates with respect to offering risk-focused investments. If you’re still on the hunt for risk-focused investments, check out these funds:

Aptus

Ticker: DRSK

GPA: 4.3

Return Since Valentine’s Day (2020): +1.96%

2019 Full Year Return: 13.93%

An actively-managed strategy that seeks income and growth through a hybrid fixed income and equity approach. The strategy invests 90-95% of its assets to obtain exposure to investment-grade corporate bonds, with the remainder seeking gains in long-term in-the-money call options on selective large cap stocks and sectors.

Cambria

Ticker: TAIL

Return Since Valentine’s Day (2020): 19.29%

2019 Full Year Return: -14.27%

The Cambria Tail Risk ETF seeks to mitigate significant downside market risk. The Fund intends to invest in a portfolio of “out of the money” put options purchased on the U.S. stock market. TAIL strategy offers the potential advantage of buying more puts when volatility is low and fewer puts when volatility is high. While a portion of the fund’s assets will be invested in the basket of long put option premiums, the majority of fund assets will be invested in intermediate term US Treasuries. As the fund is designed to be a hedge against market declines and rising volatility, Cambria expects the fund to produce negative returns in the most years with rising markets or declining volatility.

ARGI/Amplify

Ticker: SWAN

GPA: 4.3

Return Since Valentine’s Day (2020): 0.71%

2019 Full Year Return: 22.04%

The BlackSwan ETF seeks investment results that correspond to the S-Network BlackSwan Core Total Return Index (the Index). The Index’s investment strategy seeks uncapped exposure to the S&P 500, while buffering against the possibility of significant losses. Approximately 90% of the ETF will be invested in U.S. Treasury securities, while approximately 10% will be invested in SPY LEAP Options in the form of in-the-money calls.

Check out the Nitrogen Partner Store and each fund’s website for additional information to aid your due diligence.