Give your clients market confidence in seconds

WITH NITROGEN STRESS TESTS AND SCENARIOS

It’s as easy as the click of a button to assess and stabilize your clients’ comfort level with their portfolio with the power of Stress Tests in Nitrogen.

Help your clients overcome fear

When investors see the stock market go down during a recession, it can be difficult to stay calm. Negative headlines amplify fear, and bad news spreads like a digital wildfire–making it more difficult than ever to convince clients their investments are safe.

With stress testing and scenario analysis, you can instantly show your clients how their portfolios could perform during specific market events and finally settling the question, “Why is the market beating my portfolio?” This gives clients a better understanding of what could happen in the future, based on modeled performance during a given market scenario.

Financial advisory firm co-founder and president Michael said, “When I saw Nitrogen for the first time, I knew immediately that it would be essential for managing client expectations.”

Beat bad investment decisions

When market volatility happens, fear can lead to poor investment decisions. Even in bull markets, clients often wonder why the market is beating their portfolio. In both of these situations, the most successful financial advisors find a way to proactively communicate with their clients to level-set expectations and avoid costly investment mistakes.

When leveraging investment stress tests and scenarios, advisors are able to stay connected with their clients, get on the same page about the clients’ portfolios, and give clients instant peace of mind without spending hours in conversation.

“Nobody can predict the future, and they certainly can’t avoid market panics. But with Nitrogen, we can ensure that our clients are financially and emotionally prepared for what’s to inevitably come,” said financial advisor, Tom.

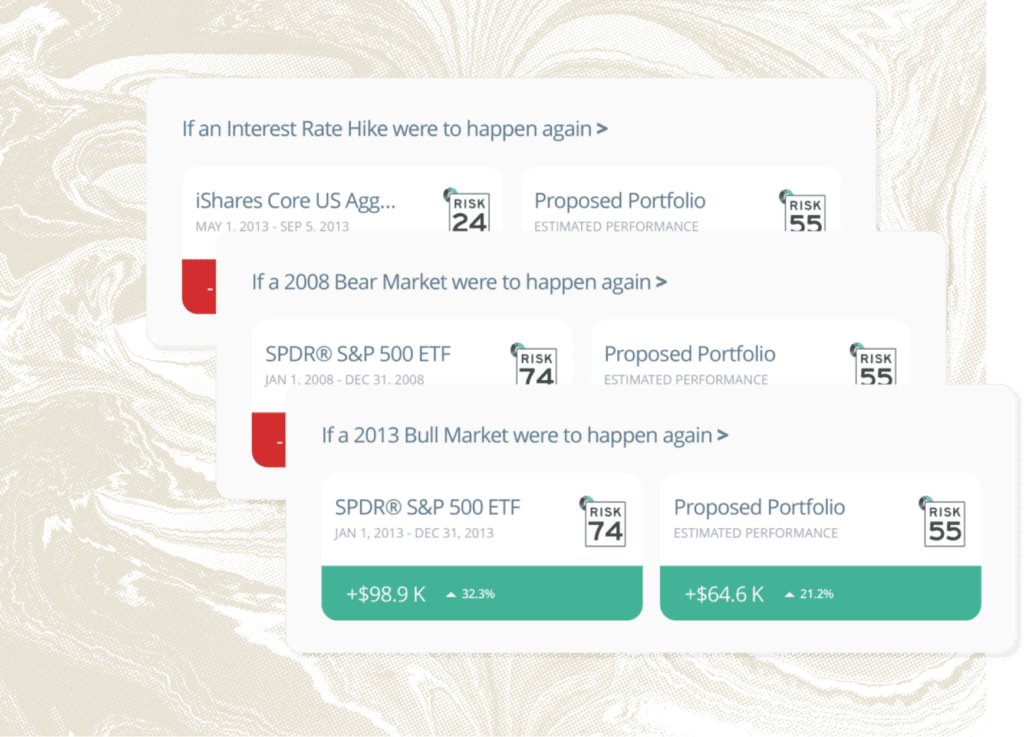

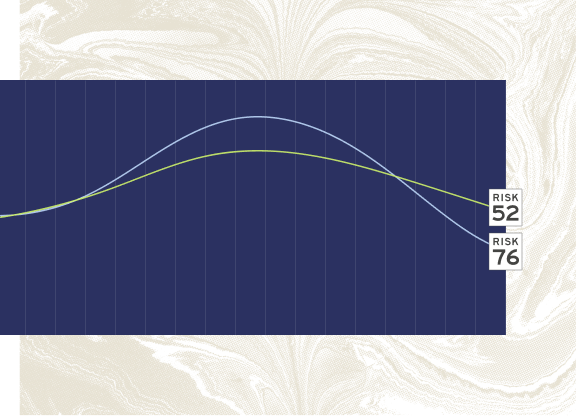

How stress tests and scenarios work

Scenarios is an interactive feature that helps to align your client’s or prospect’s portfolio with just the right amount of risk they are comfortable with. Within Scenarios, you can toggle between stress tests and historical mode. The historical mode shows the modeled performance for how your client’s or prospect’s portfolio could have performed during a past market event. Portfolio Stress Tests are an even more in-depth way of looking at historical comparisons. Imagine if the same 2008 Bear Market happened again today. With Stress Tests, we can show how a portfolio could perform. See Scenarios and Stress Tests in action below.