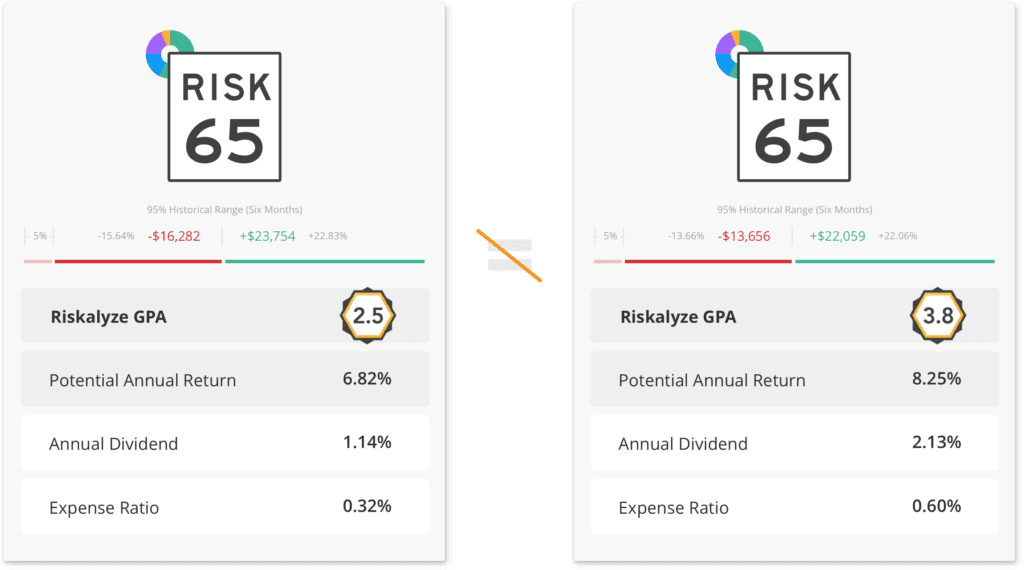

Not all Risk Number 65’s are created equal

How can you decide between two similar investments or portfolios? If efficiency is what you’re looking for, we’ve got good news—it’s time to let math do the work for you and highlight the difference between a 2.9 GPA fund and a 3.8.

The GPA is a quantitative expression of the efficiency of an investment, strategy, or portfolio with respect to how much return is realized or expected per unit of risk.

Based on a scale of 1.0 on the low side and 4.3 on the high side, the GPA of a portfolio, stock, mutual fund, or ETF helps you understand the relationship between expected performance and potential downside so your clients know their holdings are working in the most efficient manner.

Win prospects over like never before

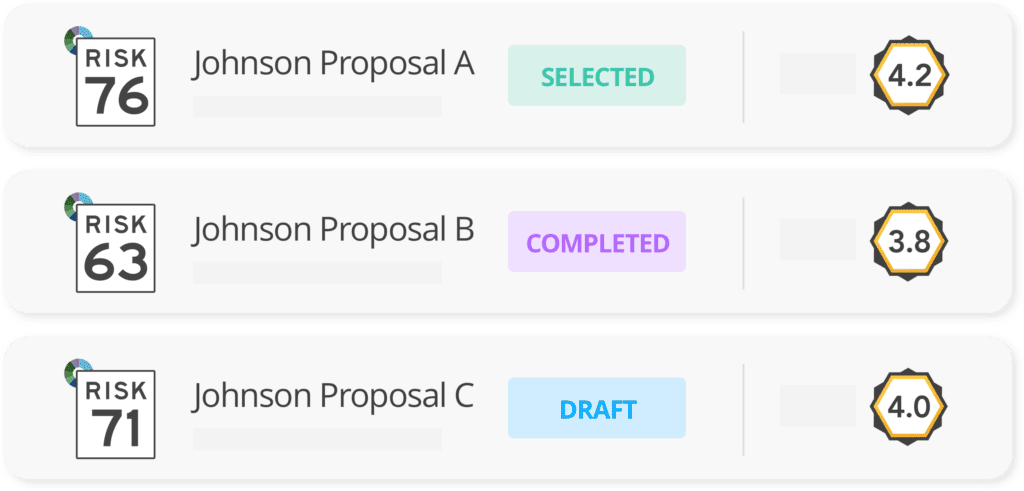

Looking to harness that “ACAT form moment?” Most of the time, showcasing alignment with the Risk Number does the trick, but GPA puts another powerful tool in your arsenal so you can set your proposals apart.

Now you can give your clients the power of choice by showing a variety of portfolios with different Risk Numbers or GPAs and allow them to select the investment objectives or investment products that suit them best.

Every tool at your disposal.

It’s never been easier to set expectations with clients, prove your fiduciary care, and grow your business.

Nitrogen Elite

Nitrogen Elite