The Billion Dollar Formula Part 2: Processes

In this three-part series, we dive into the workings of the billion-dollar RIA. We’ve included excerpts from our white paper, “The Billion Dollar Formula,” to show how billion-dollar RIA’s supercharge growth by adopting the right processes and right technologies for scale.

TRUSTING IN PROCESSES

As an advisor today, there will come a point where you will have to make the transition into a leader tomorrow. The evolution of leadership is a universal truth in the path to a billion. Either you or a hired CEO have to step in and become—in title and in practice— the CEO.

Most financial advisors love working with clients, and helping people achieve their financial goals has been a primary motivator. But if an advisor ever hopes to achieve the billion-dollar goal, they’ll need to dramatically reduce the time spent working on the “plumbing” of the business and increase the time spent on the “poetry” of the business, as James March wrote in his book, On Leadership.

Having executives for big-picture planning also helps identify and eliminate inefficient processes. When starting as a solo advisor, or even as a small team, it’s normal to take on many tasks in order to reduce overhead or simply because it’s much easier to do in the short term. As needs change and more clients require more attention, inefficiencies in processes can prevent upward mobility. For example, if an advisor is meeting with clients, then entering trades on the back end, prospecting for new clients, and also handling billing—there will be a cap on the number of clients they can have and still maintain exceptional service. For the sake of keeping costs lower, firms can jeopardize their ability to capture AUM or have happy clients.

In one example, coordinating the handoff between client intake, client meeting, and client follow-up is a process that can get complicated for smaller firms. When preparing for a client meeting, it can be easy for each team to be confused or overwhelmed.

- Who will make sure that all client information is up to date in our CRM and other software?

- Who will print the reports and when will they be handed off?

- Who will enter action items following the meeting?

- Who will follow up with clients in different contexts?

Instead of assuming task ownership, flowcharts for each stage of the process reduces friction and alleviates stress points.

Prioritizing tasks and handoffs, as well as creating workflows that better serve clients, are processes that must undergo consistent reevaluations as firms grow larger. While executives are captains, there are still many moving parts that must work together in order for a ship to sail. Getting off the deck and into the bridge can help firms see their potential, and identify processes that are holding them back.

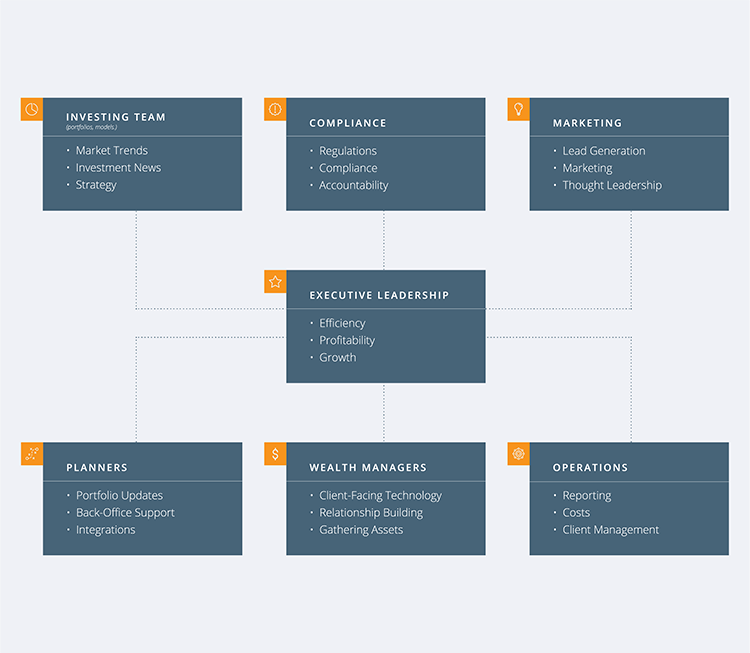

A large advisory firm isn’t structured too unlike a large corporation or even a broker-dealer for that matter. Building out this structure and creating fluid processes gives the firm the foundation it needs. To plan for a billion, don’t just build up, invest internally and build out. Firms can organize these processes in two ways: investing in technology solutions that can accommodate more AUM as they grow and creating an organizational structure that allows individuals to specialize.

To read more of The Billion Dollar Formula, download our free white paper.