Enhance Your Clients’ Tax Efficiency and Your Due Diligence Process with Tax Drag

When you’re building a proposal for a client, you need a due diligence process. Perhaps you start your fund screening process in Discovery, dive into Individual Security Analysis, and then move to Detailed Portfolio Stats before finalizing the proposal.

Regardless of how you perform your investment research, the Nitrogen growth platform has the analytics tools you need to prove to clients you are working in their best interest and win over prospects.

Today, we’re excited to launch Tax Drag into Individual Security Analysis.

Tax Drag is defined as the reduction of a portfolio’s annualized return due to taxes. It’s the tax liability triggered by distributions and capital gains in a non-qualified account. But, we can dive further than the portfolio, we can look at the Tax Drag of each individual holding within a portfolio, proposal, or model to make sure we’re building the most tax-efficient portfolio possible.

Pretty much every investment manager talks about tax efficiency, but very few provide understandable metrics to demonstrate it. Just like high expense ratios drag down returns, inefficient tax management has a massive impact on your clients and the assets they have invested with you.

Using Tax Drag in Individual Security Analysis

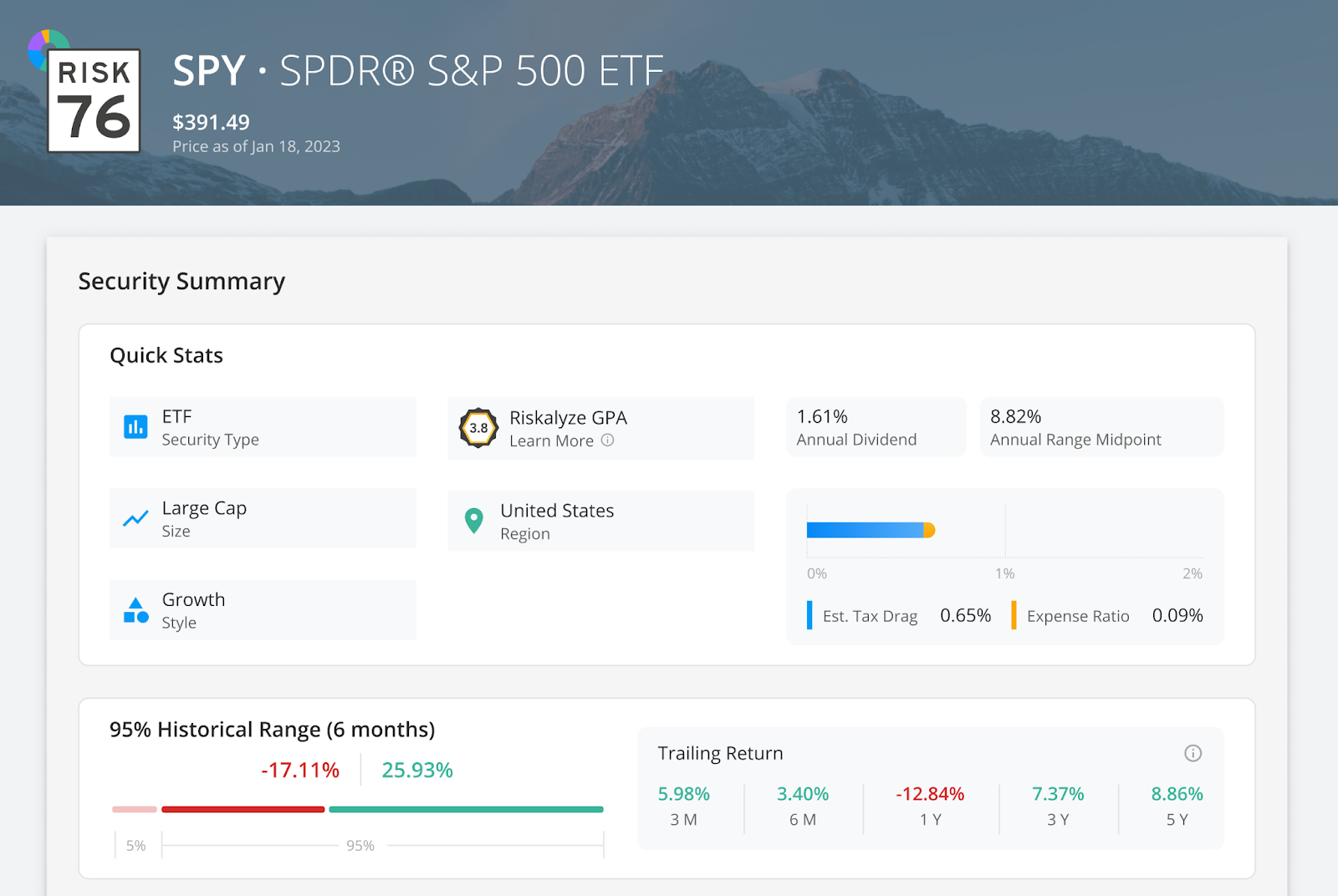

The next time you click into an individual holding or search for a ticker you’ll be met with the proprietary analytics you’ve come to know and love like the Risk Number, 95% Historical Range, GPA, and now Tax Drag.

How is Tax Drag calculated?

The Tax Drag calculation measures the percentage by which an ETF or Mutual Fund’s annualized pre-tax return is reduced by taxes. For example, a $500,000 holding with a Tax Drag of 1.5% has incurred an annualized tax liability of $7,500 of the holding value. By reducing this tax liability, the money saved would stay invested and compound over time.

The Tax Drag calculation is determined by dividing the after-tax return by the pre-tax return for a specific holding and assumes investors pay the maximum federal rate on capital gains and ordinary income rate (currently 37% and 20%, respectively).

The after-tax return reflects the after-tax distribution return, meaning it does not include any assumptions or consideration for the tax consequences incurred for selling or liquidating positions. Distributions are assumed to be reinvested on the pay date.

Note, Tax Drag represents the reduction to the 3-year annualized return resulting from income taxes. The calculation also excludes any state and local tax liability

If you’re on Nitrogen Elite, you have access to Tax Drag in Individual Security Analysis today!

New to the Nitrogen growth platform? Take an Interactive Tour of the platform and subscribe to Nitrogen updates to get the latest announcements on tax drag and other product features.