Integration, Not Isolation: Why Your WealthTech Matters for Growth

As financial advisors grapple with an increasing array of technological tools designed to enhance growth and efficiency, the importance of choosing technology partners that emphasize integration has never been greater. The reason is simple—integrated technologies speak to each other, streamlining processes and amplifying productivity.

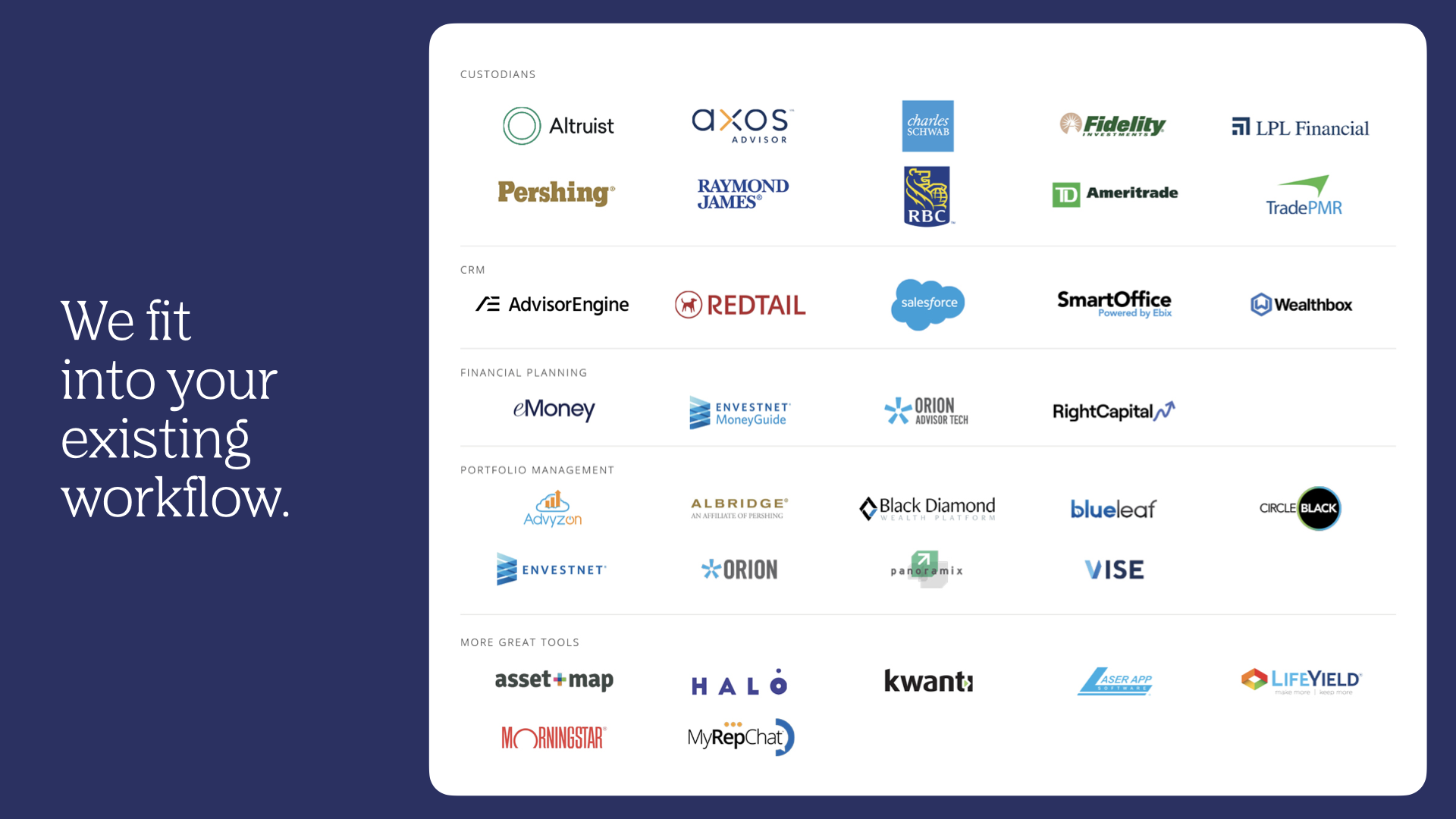

In contrast, isolated, siloed, or all-in-one systems often lead to inefficiencies, redundancies, and communication breakdowns, becoming barriers rather than enablers of growth. At Nitrogen, we understand this dynamic deeply and strive to make integration a cornerstone of our offerings. It’s why we integrate with over 50 best-in-breed organizations because we believe when advisors are able to choose the best solutions, clients benefit. This blog post will explore why choosing technology partners who prioritize integrations is integral for wealth management firms seeking to scale.

The Importance of Integrations

Integrations in wealth tech serve as the backbone of a firm’s technology infrastructure, linking various tools, systems, and data to ensure they work harmoniously towards the common goal of business growth. In any advisory firm, where complex transactions, vast amounts of information, and intricate client relationships are the norm, the role of technology integrations cannot be overstated. Integrations foster enhanced communication between various platforms, eliminate the need for manual data entry, and reduce the chances of errors, enabling firms to deliver more efficient, reliable, and personalized service.

Moreover, they allow for automated workflows, freeing up valuable time for financial advisors to focus on what truly matters – advising their clients and growing their business. On the flip side, a lack of proper integrations can lead to disjointed operations, inefficiencies, and potential miscommunications, obstructing growth and scalability. In essence, well-implemented integrations serve as a conduit for information flow, enabling financial advisors to operate more effectively, make better informed decisions, and provide superior service, all of which are crucial for growth in today’s competitive marketplace.

All-In-One vs. Best-In-Breed

While the appeal of all-in-one wealth management solutions is understandable, it’s crucial to consider the potential pitfalls that can arise from such a ‘boil the ocean’ approach. These encompassing systems often promise to provide a complete solution to all of a firm’s needs, aiming to cover all areas of wealth management within a single platform. For new firms under $10m in AUM, this could be a convenient path. As a firm grows past the $10m AUM mark, all-in-once solutions can introduce redundancy, hinder scalability, and limit a firm’s ability to truly customize their technology stack.

The first concern for growing firms is redundancy. These broad systems often include features and functionalities that may not be relevant or necessary for every firm. This means firms might end up paying for features they don’t use, leading to wasted resources. Additionally, these unused features can clutter the system, making it more complex and difficult to navigate.

Scalability is another potential issue. While all-in-one solutions may work well for firms at a certain introductory stage, they may not scale up or down effectively as a firm evolves and moves between the four growth stages. As firms expand, their requirements become more complex, demanding more flexibility and customization than what all-in-one solutions can typically offer.

Furthermore, the ‘boil the ocean’ approach can limit a firm’s ability to build a technology stack that truly aligns with its clients’ unique needs. The one-size-fits-all nature of these solutions often lacks the flexibility and customization provided by a carefully selected suite of specialized tools. As a result, firms may have to adjust their operations to fit the tool rather than having a tool that fits their operations.

In contrast, Nitrogen’s integration-focused approach provides a more efficient, scalable, and customizable solution. By allowing firms to select and integrate a variety of specialized tools and have the data work back and forth together, we help firms build technology stacks that truly cater to their unique needs, supporting growth rather than hindering it.

The Benefits of Choosing the Right WealthTech Partners

So with all this in mind, choosing the right technology partners is a decision that extends beyond the immediate functionality of their tools. When it comes to scaling a wealth management firm, partners who prioritize integrations can be a game-changer. Such partners understand that their technology is not an island but a part of your firm’s broader tech ecosystem. They see the value in ensuring their tools not only work optimally in isolation but also synergize seamlessly with other tools in your arsenal, thereby enhancing your firm’s overall technological capabilities.

Prioritizing integrations means these partners invest in creating APIs, provide robust technical support, and often collaborate with other tech providers to ensure their solution fits seamlessly into your tech stack. At Nitrogen, for example, we’ve set up numerous instant messaging channels with our top integration partners. Our teams are often able to share integration enhancement ideas or generate quick fixes in minutes, instead of waiting on support phone lines. Integration-first wealth technology providers understand that their product’s value is amplified when it can ‘speak’ and ‘listen’ to other systems, automating data flow, reducing errors, and enhancing operational efficiency.

Furthermore, tech partners who prioritize integrations often have a growth-oriented mindset. They recognize that as your firm scales, your technology needs might become more complex. They are prepared to work with you as these needs evolve, ensuring their integrations can support your firm’s growth trajectory rather than being a roadblock. They provide solutions that are adaptable, scalable, and designed to handle increased complexity, allowing your firm to grow without being hampered by technological limitations.

Choosing wealth tech partners who prioritize integrations is like choosing to navigate a complex network of roads with a reliable, sophisticated GPS rather than an outdated map. Sure, you can buy a one-size-fits-all map of the entire country, but the journey becomes smoother, the risks of wrong turns are minimized, and the destination—growth and scalability—becomes that much more attainable when your tools are specifically focused on your destination.

What to Look for in WealthTech Integrations

When evaluating wealth tech integrations, there are several key aspects you should consider to ensure you’re investing in technology that will effectively support your firm’s growth and unique needs.

Firstly, consider the ease of use. An integration that is difficult to use or understand can lead to frustration, and decreased productivity, and may even deter your team from using the technology altogether. User-friendly interfaces, intuitive design, and clear instructions for setup and operation are crucial.

Next, consider compatibility. The best integrations are those that fit seamlessly into your existing tech stack and can interact smoothly with a wide range of other software solutions. They should not require massive overhauls of your existing systems or processes but rather enhance and streamline them. You can see how Nitrogen connects with your current technology using our Tech Stack Builder guide, recognized by the Wealth Management Industry Awards as a top tool for wealth management firms.

The level of support provided by the tech partner is another vital consideration. Implementing new integrations can sometimes come with a learning curve or unexpected challenges. Partners who offer robust support—whether it’s through comprehensive documentation, responsive customer service, or hands-on technical assistance—can make the implementation process significantly smoother.

Lastly, don’t underestimate the importance of customization. Every wealth management firm has its unique set of needs and challenges, and a one-size-fits-all solution is unlikely to meet all your requirements. Look for integrations that offer a degree of customization, allowing you to tweak the functionality to suit your firm’s specific needs.

Remember, the goal of integrating technology into your wealth management firm is to enhance your operations, improve efficiency, and support scalability. With these considerations in mind, you can select WealthTech integrations that align well with your firm’s objectives and unique business needs, ultimately setting your firm on a clear path to growth.

The Role of Nitrogen in WealthTech Integrations

At Nitrogen, our primary focus is building the solutions that help wealth management firms grow. We recognize that in today’s financial landscape, an integrated technology approach is no longer a luxury—it’s a necessity. That’s why we have made it our mission to ensure that our software solutions not only provide outstanding standalone functionality but also integrate seamlessly with other crucial tools in your tech ecosystem. We’re proud to connect with over 50 tools and counting while also bringing together the industry’s top fintech at our annual Fearless Investing Summit.

Nitrogen is designed with scalability in mind, making it perfect fit for wealth management firms at every stage of growth. We understand that as firms expand, their needs become more complex. Hence, our solutions are flexible and customizable, designed to adapt and scale with you as your firm evolves.

Our commitment to integration extends to our collaboration with other technology providers. From CRMs to Custodians to Marketing and more, we work diligently to ensure our software interfaces smoothly with various platforms. In fact, we’re often adding new integration partners throughout the year. This commitment not only means smoother day-to-day operations for our clients but also less time spent on manual data entry, lower chances of error, and more time available to focus on providing excellent service to clients.

We also place a strong emphasis on customer support. We understand that the implementation of new technology and integrations can sometimes pose challenges. That’s why our Customer Care team is always on hand to provide technical assistance, guide you through the setup process, and address any issues that arise. To view all available training opportunities, visit our training page here.

At Nitrogen, we believe that your technology should be an enabler of growth, not a barrier. With our commitment to seamless integrations, scalability, and exceptional customer support, we aim to provide wealth management firms with the tools they need to scale efficiently and effectively, navigating the path to growth with confidence and clarity.

In conclusion, the power of integration in WealthTech is not to be underestimated. It’s the key to unlocking seamless operations, greater efficiency, and scalable growth within wealth management firms. Choosing technology partners who prioritize integrations and understand your firm’s unique needs can significantly enhance your firm’s ability to grow and serve clients effectively.

At Nitrogen, we are committed to fostering this power of integration. With our robust solutions, seamless integrations, and unwavering customer support, we aim to empower wealth management firms to reach their full potential. Our mission is to ensure that technology serves as a facilitator, not an obstacle, to your firm’s growth.

We invite you to explore our integration page and discover how our commitment to getting integrations right can help your firm navigate the path to scalable growth. For any further information or inquiries, our team is always ready to assist. Let’s embrace the power of integration together and shape the future of wealth management.