Searching for Fixed Income Investments in Discovery

Since we launched Discovery, we’ve been on a mission to make it the world’s fastest fund screener and investment research tool for advisors. Thousands of advisors have adopted Discovery as their primary method to search, sort, filter, and favorite their top stocks, ETFs, mutual funds, and SMAs for clients.

And with the All-New Portfolios Experience, you can easily add those favorites directly into a portfolio or proposal making your workflow even faster, but we aren’t finished innovating with Discovery!

Today, we’re announcing the biggest update to Discovery to date. Fixed Income is now available for screening.

Today, we’re announcing the biggest update to Discovery to date. Fixed Income is now available for screening.

We are excited to announce that users on Nitrogen Select and Nitrogen Elite can now search for fixed income products using four new filters inside of Discovery.

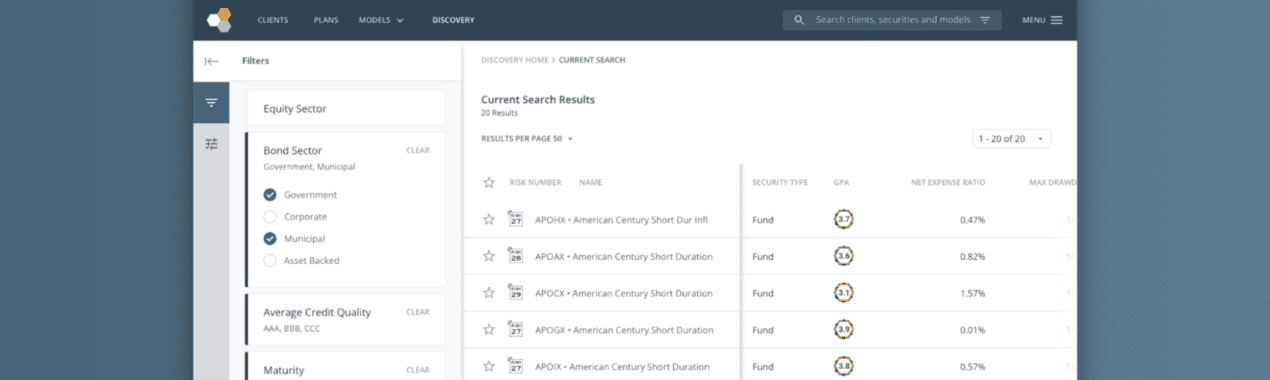

Breaking Down The Filters

In order to find the right fixed income investments for your clients, you need the right filters. We’ve made it easy to find exactly what you are looking for with the four new filters.

- Bond Sector – This filter allows you to choose between four main sectors including government, corporate, municipal, and asset backed bonds.

- Average Credit Quality – Filtering by the credit quality will narrow your results based on the Standard & Poor’s and Fitch Ratings credit ratings (ex. AAA, AA, A, BBB, etc.)

- Maturity – Narrow down your results based on how long it takes for the investment to return the original principal back to the holder.

- Duration – Narrow down your results based on their sensitivity to interest rate changes.

Armed with these new filters, Discovery continues to grow into an advisor favorite. Just look at what others have been saying the past few months.

“I love all of this!”

– Andy, advisor in Ohio

“I am looking to move off [my outdated

systems] because Discovery is awesome.”

– Jay, Advisor in Texas

Not sure where to start with Discovery?

If you are not familiar with Discovery, you’re going to love quickly diving into research based on your most important search criteria including the Risk Number, GPA, expense ratios, and more.

And it doesn’t end there — Discovery has 19 different filters that allow you to sort, search, and filter to your heart’s content. Finding the perfect stock, mutual fund, ETF, SMA, and now fixed income product for your clients has never been easier.

And, if you are on Nitrogen Elite, you can hop from Discovery straight into Individual Security Analysis and start generating powerful reports making Nitrogen your one-stop-shop for all your analytics and research.

Want to check out Nitrogen for the first time? Request a demo here and a specialist would love to show you around.