New Ways to Screen Securities in Discovery!

Since we launched Discovery in the fall, advisors have loved the pace in which we’ve added functionality to their new favorite fund screener, and we’re prioritizing our enhancements based on all the research we’ve gathered from those incredible advisors we love to serve.

Today, we’re announcing three new features in Discovery that will help you search for securities, manage and sort your columns, and find similar securities that you might not have found otherwise.

We are announcing three new features in Discovery that will help you search, manage, and find the securities you need.

Search just became your superpower.

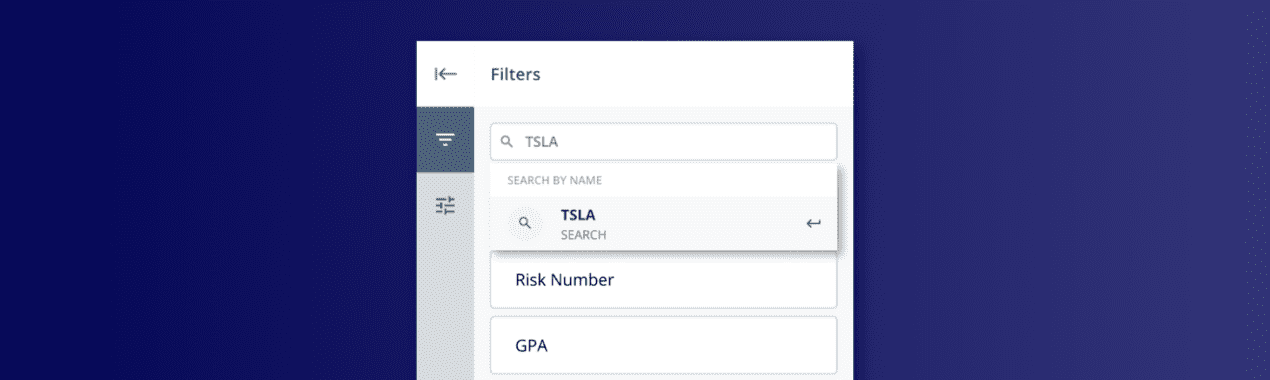

One of the best ways to navigate Discovery is by using the 14 filters along the left side of the screen. With just a few clicks, you can narrow down from thousands of securities to just a handful before diving further into your research with Individual Security Analysis. You can even move faster by using the quick filter bar to filter by Risk Number, GPA, equity sectors, and more.

Today, we’ve added some incredible new search capabilities into the quick filter bar. You can now search by name! Whether you want to search for a specific ticker or keyword such as TSLA, Energy, Healthcare, or Blackrock, Discovery will filter through more than one million securities and find the perfect securities that match your criteria in a matter of seconds.

Move, expand, and toggle columns to fit your needs!

To help make Discovery as fast and efficient as possible, we’ve added a new column manager in the left side panel. It’s as simple as clicking on the Filter icon and making your adjustments on the fly. Now you can add or hide columns, reorder columns, and even resize certain columns.

Can’t find the perfect match? What about a similar security?

Now, maybe you’ve found a good investment for a client but it’s not perfect. That’s why we’re introducing Similar Securities to help answer the question, “Did I actually find the best product for my client?”

The next time you land on an individual security, Discovery will prompt you to look at a few similar securities that might also fit the bill for your client. Discovery uses an intelligent algorithm to source similar securities based on a set of criteria including security type, market cap size, style, and equity sector.

Need more help with Discovery?

We’ve got you covered! The industry’s best Customer Care team would love to connect. We’re standing by in so many ways — from hands-on training, self-guided programs, or Nitrogen Labs — we’ve got you covered.

On a legacy plan that doesn’t include Discovery? We’d be happy to show you around and answer any questions you may have.

We hope you enjoy these enhancements — thanks for empowering clients to invest fearlessly!