How Financial Advisory Firms Can Use Email to Get More Clients

Email marketing is just as relevant in finance as in any other industry. As someone running a financial advisory firm, you can strengthen your business by upping your email game. Financial advisor email marketing can help your business stay top of mind and generate new clients.

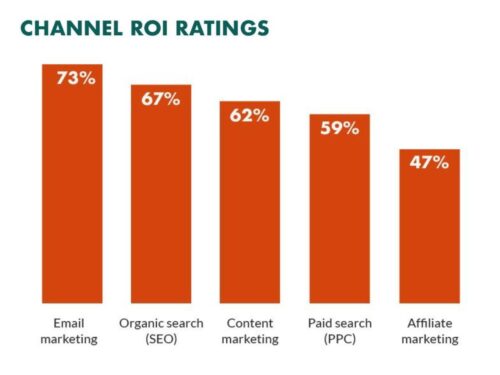

Don’t believe me? Look at the statistics. Recent statistics show that marketers believe email marketing is the most effective marketing channel. Also, 73% of customers prefer email as their main channel for business communication:

Financial advisor email marketing is important if you are looking for lead generation, sales, lead nurturing, and client retention. Email also delivers the best return on investment (ROI). Studies have shown you get a $42 return for every dollar spent.

The thing is, you can’t just churn together some words and send bulk emails. Your email will likely end up in spam folders, or you’ll have most of your mail contacts unsubscribe. Financial advisor email marketing must be done well for it to yield the results you want. One can take guidance from various email marketing software for precision and approach.

That said, here are some tips for putting together a successful email marketing campaign that generates clients for financial advisory firms.

1. Identify Your Email Objective

When you don’t have the right email objective, you’re more likely to write an email that doesn’t speak to your potential client’s pain points. The result is that they are far less likely to be primed and ready to respond to your call to action (CTA). The unsubscribe rate would also be high, or worse your mail will end up in spam folders.

So, you need to spend some time thinking beforehand about your message. Do you want to build trust? Boost your authority as a financial advisory firm? Recommend a financial plan?

Your email goals should depend on your audience. So, make sure you survey your target clients so you can know more about them and their financial wellness and objectives. Once you’ve determined your email objective/s based on your client persona, you can start crafting your message.

2. Personalize Your Emails

When crafting your emails, you must ensure your message is personalized. That’s a basic rule in email marketing and, therefore, in financial advisor email marketing, too. Statistics show that personalized emails deliver 6x higher transactional rates.

You can personalize your emails in several ways. One way is to use your potential client’s first name. Use this in the email subject line and the email body.

Your content should be personalized, too. That means you should write your email content bearing in mind the email goals you determined beforehand. Don’t send an email that doesn’t apply to the specific financial situation of your potential client.

Email segmentation can help you personalize your emails. You can segment your email list according to your subscribers’ financial situation, their age, and even based on whether they’re a new subscriber or not. The more segmented your email is, the more tailored your email message can be.

3. Provide Valuable Content

Let’s say you’ve sent your first email. Congratulations! But your job doesn’t end there. After all, chances are, your potential client won’t take your desired action after your first email. You have to keep on sending more emails to nurture the relationship and, hopefully, bring them down the sales funnel.

This is where valuable content can help. Valuable content doesn’t just help you nurture relationships with your email subscribers. It also helps you boost your authority as a financial advisory firm.

But what exactly is valuable content? That, again, depends on your target audience. Go back to your client persona and see your subscribers’ pain points. Then produce content–blog posts, podcasts, infographics, among others—that helps address those pain points.

In crafting your email, make sure you use simple language. Put yourself in the shoes of your potential client. If you send them an email full of financial jargon, such as net income and EBITDA (earnings before interest, taxes, depreciation, and amortization), you’re more likely to scare them away. What’s the point of having valuable content to potential clients if they don’t understand it in the first place? If you really need to use technical jargon in your email, define it in layman’s terms.

Answer your customers’ questions before they even get a chance to ask them, and they’ll see you as a resource to visit time and time again.

But don’t just focus on your emails. Provide valuable content on your other marketing platforms, too. You can share your valuable content on your socials. You can also post them on your website. Just make sure your site uses the fastest web hosting so that when your target clients access it, they get a user-friendly experience.

Organize your website articles into content hubs as well. This will make it easy for visitors to look for the content they want. Also, it can help your website’s SEO.

4. Have a Click-Worthy CTA

Great CTAs are more than just buttons at the end of your email. The CTA is the climactic point of the email. It’s where the story has reached an inflection point, and the subscriber gets to decide how the rest of the story plays out. Like the climax of a story, the CTA doesn’t work unless the other parts of the story build up enough interest.

5. Send Emails at the Right Time

Don’t just send your emails whenever you feel like it. You have to ensure you send your emails at a time they are more likely to be opened.

Data from Twenty Over Ten shows that Monday at 6 pm is the best time for financial advisor emails to go out. Messages sent around this time appear to have the best average open rates as subscribers are refreshed after the weekend.

You should also consider your audience to determine the best time to send emails. As a financial advisory firm, for example, you would know your clients’ occupation. Go back to your client persona. You could make an informed guess as to when they return home or resume work hours based on their occupation and determine the best time to send from there.

So, let’s say your target audience consists of young professionals who have a 9 a.m. to 5 p.m. job. Sending emails when they get to work and check their inboxes in the morning may then yield better results than if you send the emails after 5 p.m. After all, it’s safe to assume your target audience is already resting at this time and is, therefore, no longer checking their inboxes.

In Closing

Email marketing can help boost your financial advisory business. With the right content, you can generate more clients.

You learned six financial advisor email marketing tips from this article. Identify your email objective first by knowing your audience. Create personalized emails. Nurture your potential clients with valuable content, too. Also, make sure you have a click-worthy CTA. Finally, send your emails at the right time.

Do email marketing the right way, and you’ll see those clicks and conversions shooting up. You can generate more clients and grow your financial advisory business. Good luck!

Matt Diggity is a search engine optimization expert and the founder and CEO of Diggity Marketing, The Search Initiative, Authority Builders, and LeadSpring LLC. He is also the host of the Chiang Mai SEO Conference.

Matt Diggity is a search engine optimization expert and the founder and CEO of Diggity Marketing, The Search Initiative, Authority Builders, and LeadSpring LLC. He is also the host of the Chiang Mai SEO Conference.