By: Nick Harding, MBA

Senior Managing Director of Care and Success

Do you ever sit down in your favorite chair on a Friday night, start up Netflix, and then spend thirty minutes scrolling through thousands of on-demand television shows and movies—only to put your iPad down because “there’s nothing to watch?”

We live in a world of limitless possibilities where activities that used to require a full night out can now be started up with a finger tap in our home, and yet we still find ways to complain.

Netflix has recognized that its users sometimes need a little additional guidance in deciding what to choose, and it’s been making design updates to help return more relevant content. The company just updated its menu to include a “New and Popular” tab to get you watching its latest documentary with less taps and clicks.

Here at Nitrogen, we recently upgraded the Risk Number questionnaire to what we call the Next-Gen Risk Assessment. It’s as seamless, smooth, and easy to use as possible—much like choosing a show to watch on Netflix.

Our product teams gathered a tremendous amount of research and data from extensive trials to arrive at the most intuitive user experience that is still built upon the robust methodology we’re known for. And still, from time to time, we’ll hear about an advisor who is struggling with a client when it comes to engaging with the risk assessments.

It sounds a bit like those of us who still can’t find anything to watch on Netflix—and if that’s your client—there’s still hope for them!

Here’s the bottom line: every client is different.

If you’re an advisor who’s ever gotten a comment from a client about not liking risk assessments, we’re here to help you optimize your approach by making your conversation about risk as relevant and enjoyable as possible for your clients.

Here’s a step-by-step guide for how to run your meetings and lead your clients to a better understanding of their personal risk, and a greater appreciation for what you do.

How to Run a Perfect Meeting using Risk Assessments

The next time you have a client in your office and you want to talk about their risk by using risk assessments, you can follow this script to make sure the process is smooth and impactful for everyone involved.

Before we get into the details, here are three high-level best practices to keep in mind.

- Best Practice #1: Communicate Clearly. Explain why you need to do a risk questionnaire in the first place. Prepare a script so you say the same thing to each client. You’ll get into a rhythm, become more confident in what you say, and create a consistent experience for everyone you work with (your clients and compliance department will thank you)!

- Best Practice #2: Ask Questions. The goal isn’t necessarily to arrive at a Risk Number as quickly as possible—risk assessments are designed to help you know your clients better along the way. That can only happen when you take time to pause and check in to make sure your client understands the ramifications of each question.

- Best Practice #3: Confirm Again. After you wrap up a questionnaire, you have the perfect opportunity to double-check anything your client seemed unsure about, and ask the all-important question: “Does this Risk Number feel like you?”

With those tips in mind, let’s look at a step-by-step guide for how to successfully take your clients through risk assessments in Nitrogen.

The Beginning: Explain the Purpose of Risk Assessments

As an advisor, you help clients understand their finances at a deeper level than they can on their own, and that’s exactly what risk assessments empower you to do.

Start by explaining that you need to quantify their risk as an individual, and also learn about the risk of the other entities a client might own—like a business they run, or their entire family household. Each entity or “money bucket” you identify can have different levels of risk which all come together to form a cohesive plan for their life.

That plan is developed by creating a new questionnaire and identifying the amount they have to invest. This step is critical, because your planning and discussion can vary greatly depending on if a client has $100,000 or $10 million to invest.

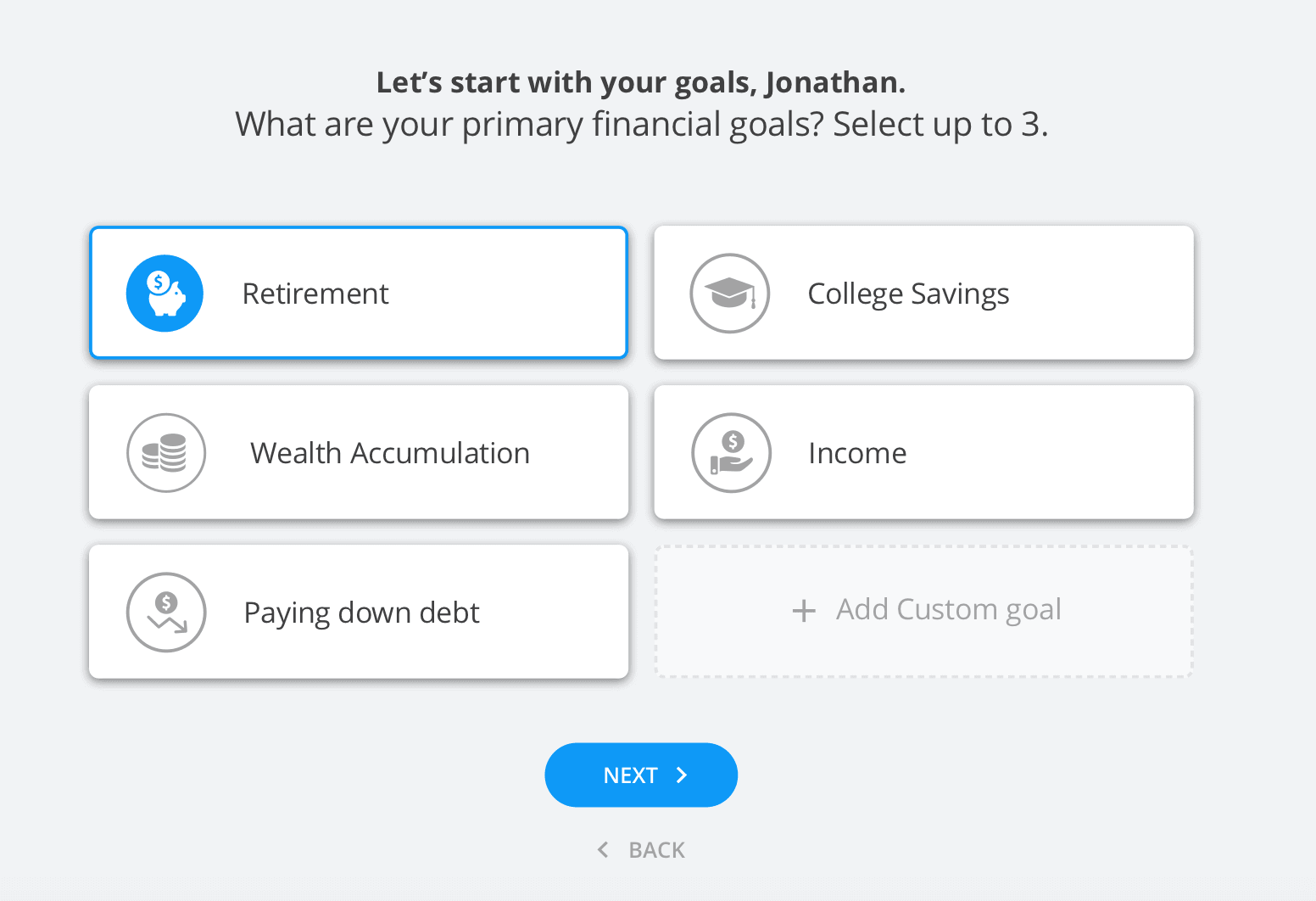

Next, risk assessments will take you into goals territory. I tell advisors not to let this part get too overwhelming. It doesn’t affect the outcome of the client’s Risk Number, and it can change over time. We’ve included it as a helpful data point for you to capture about an investor.

If you want to add more conversational opportunities, you can also create a custom goal instead of selecting from our pre-built options.

You’ll end the introductory section by setting your client’s age and retirement year. This isn’t meant to set their future decision in stone, and is designed to get you talking about when they want to make the leap into retirement.

The Middle: Tell Me How You Feel

The next part of the questionnaire is my personal favorite—and if you position it correctly, it will probably be yours (and your client’s) too.

Start by telling your client you want to get a sense of how they feel about the markets and their financial future. It’s super easy. All they have to do is give you a figurative thumbs up or thumbs down to two questions that you’ll show them. These market sentiment questions don’t affect their Risk Number either—they simply start you off with a foundation by which you can “check in” with clients over time.

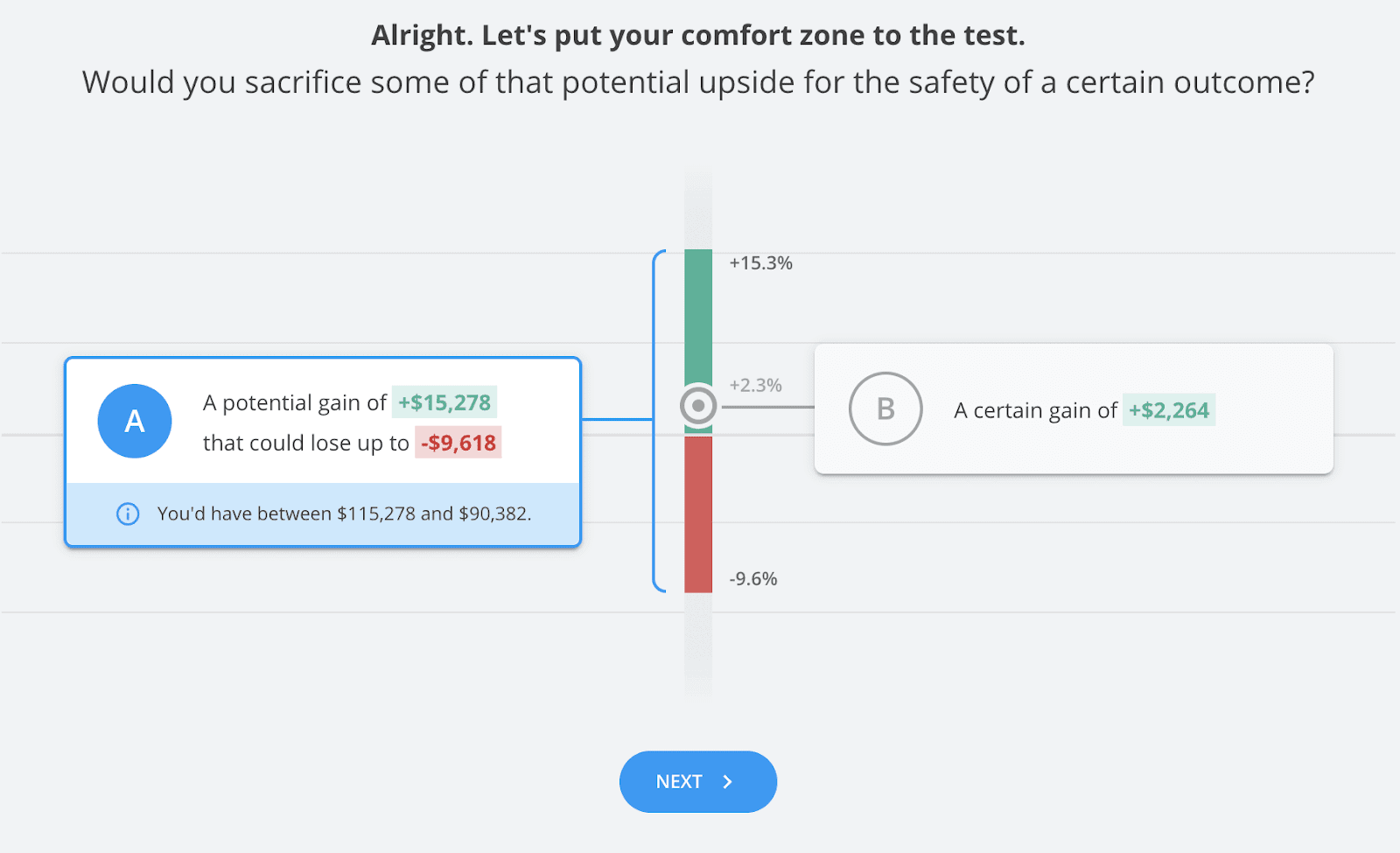

At this point, we’ve entered the risk/reward tradeoff part of the conversation where the rubber meets the road. Each question tries to get your client to think deeply about how much money they could be comfortable losing in a given time span and still feel okay about their long-term financial plan.

This part of the risk assessment is where Nitrogen truly shines. Most risk questionnaires try to figure out the percentage of a portfolio a client is comfortable with losing—but percentages don’t affect our brains the way that cold, hard cash does.

When you walk through this middle portion, you want to keep clients focused on the real, relevant dollar amount. They might tell you at the beginning that they’re okay with taking a 20% hit over a six-month timeframe, but do they still feel that way when you show them they’ll be looking at a $200,000 loss?

If I’m an advisor in this situation, this is where I want to double-down and check for understanding. Don’t be afraid to ask a question twice, especially if your client suggests they’re comfortable with losing a large amount. You want to make sure they grasp the significance of the decisions they’re making, because one day, this situation may not be hypothetical.

The Wrap Up: Putting it to the Test

The last portion of the questionnaire tasks you with finalizing your client’s mindset about risk and reward. In this section, clients are going to rate their preference between two potential scenarios.

These “what if” scenarios allow the two of you to freely discuss the merits of downside and upside possibilities. It’s also where I would recommend explaining the 95% Historical Range™. You want them to know that when you touch base again in six months and their situation falls within that comfort range, they’re still on track to reach their goals.

Here’s the catch (and why assessing risk is so important): If they want to reach those goals, you know they need to accept the possibility of some downside risk.

The “what if” situations allow your client’s to consider how they would respond ahead of time in these scenarios, and it provides you with critical information about their behavior and approach as different risk/return scenarios are presented. The “what if” questions will present scenarios like, would you rather:

-

Get a possible gain of $290,000 at the risk of losing $190,000?

-

Or would you rather get a certain gain of $37,000?

When the “what if” questions are finished, your client gets their Risk Number, and you receive the opportunity to incorporate that result into their financial plan.

Now comes the most important part. You want to make sure that they confirm that yes, that Risk Number really does “sound like me.” They should feel comfortable and confident with the number and comfort range they see.

It’s at this point that you want to reiterate that the Risk Number isn’t a static number. If anything major changes in their life, they should feel empowered to retake the questionnaire. We all adapt and change throughout our lives in large and small ways, and our risk tolerance is no different. The great news is you can email them a link for them to retake the questionnaire at home at their own convenience. They’ll already be familiar with the process since you’ve walked them through it, and they should be able to complete the new questionnaire in a few short minutes.

After speaking with multiple advisors, risk assessments improve the overall interaction for both the advisor and the client alike, as well as offer the advisor a critical opportunity to provide their unique advisor intelligence and expertise throughout the experience.

The questionnaire is your time to ask key “why” discovery questions to dig beneath the surface, get a client to think more about their financial future, and help you understand them at a deeper level.

Here are some great starter questions that you can (and should) use to follow up on answers that might surprise you so you can keep the conversation engaging:

- “What about that answer was appealing to you?”

- “What struck you about that question?”

- “Why do you think that’s the right choice for your goals?”

- “How did that question make you feel?”

The Wrong Way to Use Risk Assessments

There is one definitive way to use risk assessments incorrectly—and that is to give up on a struggling client. While many clients find these questionnaires intuitive and can take them on their own, others need a little hand holding only you as their financial advisor can provide.

There might be terms throughout the process that clients don’t understand, or questions that give them pause. These are the opportunities for you to engage in conversation, adjust your approach, and tailor the questionnaire experience to each person.

Our most successful advisors use this inherent flexibility to tailor the experience for each of their clients. If you have a client who likes to get to the point, you can be more concise and go through the questionnaire with more of a bullet point mentality than a drawn out conversation.

A financial advisor understanding a client’s desired level of risk and investment objectives is akin to a doctor needing to know a patient’s symptoms and health goals before they can prescribe a plan for long-term health.

Risk assessments allow you to leverage a process and technology to explain to clients that you have the best approach to get them to the most confident place possible.

In the End, Not Every Client Needs a Questionnaire!

As great as risk assessments are for increasing client buy-in and generating new leads, there will be many times when a questionnaire isn’t the right experience. These may be clients who you already know quite well, who aren’t detail oriented, or who have the mindset that they hired you to take all the “work” out of managing their money. Setting a Risk Target for them is a great approach to take in these situations.

“We never use risk questionnaires with clients. We use Nitrogen instead.” – Tom, advisor in Texas

That’s right—some advisors set Risk Targets for 100% of their clients! It might be because they specifically prefer that client experience, or because their institution mandates a different questionnaire or assessment process. Either way, Risk Targets are an easy way to translate their existing approach into Nitrogen and arrive at an ideal Risk Alignment for that client.

Empowering the World to Invest Fearlessly

Risk assessments in Nitrogen provide you with a solid foundation to get peace of mind about client relationships, their tolerance for risk, and their investment goals. It not only covers you for compliance, it also helps you do what you do best.

And that is to empower your clients to invest fearlessly—and in return, make a tremendous impact on their world.