CEO Aaron Klein’s Product Keynote from the 2022 Fearless Investing Summit

New Product Announcements from Summit 2022

Last week at the Fearless Investing Summit stage in Salt Lake City, we were thrilled to announce a brand-new suite of features and tools to the Nitrogen Platform that we know you’re going to love. Read on to learn more about all the exciting, new resources now at your fingertips!

Watch the Annual Keynote Address from CEO Aaron Klein

Unable to join us live in Salt Lake City or virtually? We’ve got you covered! Catch up on all the action from this year’s highly anticipated keynote address by Aaron Klein and watch it in its entirety for free below.

You’ll learn what’s new and what’s next for the Fearless Investing Movement, hear our exciting partnership news, and see all of our new product features and enhancements in action!

Check Out What’s New

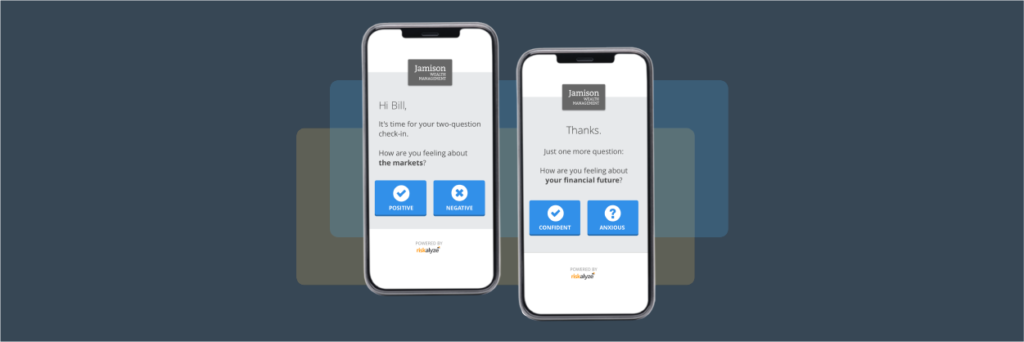

With Check-ins

Your favorite feature has gotten an upgrade! We’ve completely rebuilt how you engage with Check-ins, so you can see responses across your entire client base and sort them by status so you can see which clients might need your attention first. Check-ins are the most powerful way to keep your finger on the pulsebeat of client psychology, and now, they’re more accessible and actionable than ever before.

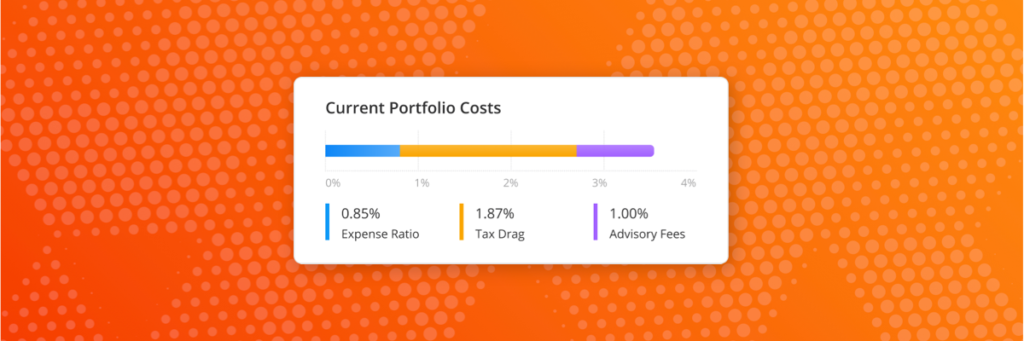

Welcome Tax Drag!

Tax Drag is defined as the reduction of a portfolio’s annualized return due to taxes. Very simply, it’s the tax liability incurred due to distributions and capital gains in a non-qualified account.

Pretty much every investment manager talks about running a tax-efficient strategy, but very few provide metrics that are easily understood and can demonstrate the tax savings to clients. With Tax Drag, we’re measuring the tax efficiency of how securities in your portfolio are managed by the investment manager.

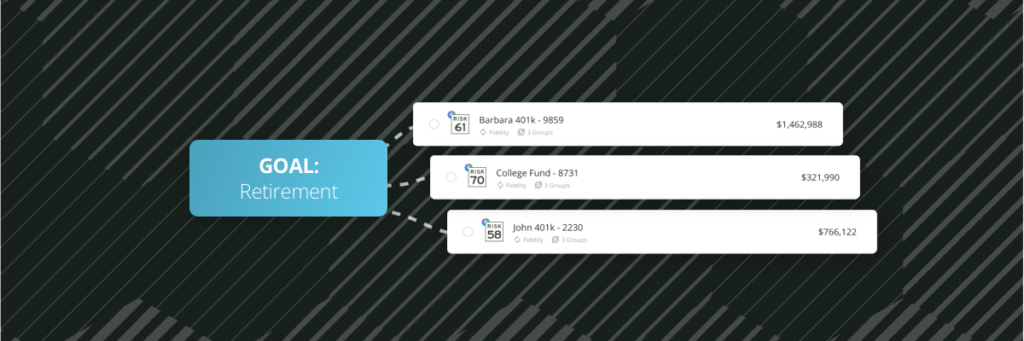

Introducing Account Groups

The All-New Portfolios Experience now has Account Groups which helps financial advisors easily categorize all their accounts. This new feature will help you increase efficiency when working with complex portfolios and will make it even easier to find the information you need.

We’re confident that Account Groups will optimize your workflow so that you have more time to spend where it matters most — with your clients.

Learn More about account groups

Meet Nitrogen Ultimate

We’re thrilled to introduce Nitrogen Ultimate — the firmwide growth platform to drive a consistent client experience across your advisors and alignment with compliance for every account.

Ultimate integrates into your CRM, asset platform, and financial planning workflows to get the growth flywheel spinning, drive a consistent client experience, deliver the insights to accelerate your progress, and protect your business value.